2022 Second Quarter Outperformance for Garrison Fathom

By Willie J. Costa & Vinh Q. Vuong

To say that the first half of 2022 has been volatile is even less insightful than to say water is wet, yet despite the media furor over continual losses, our Garrison portfolio has made good on its mission to defend invested capital regardless of broader market conditions.

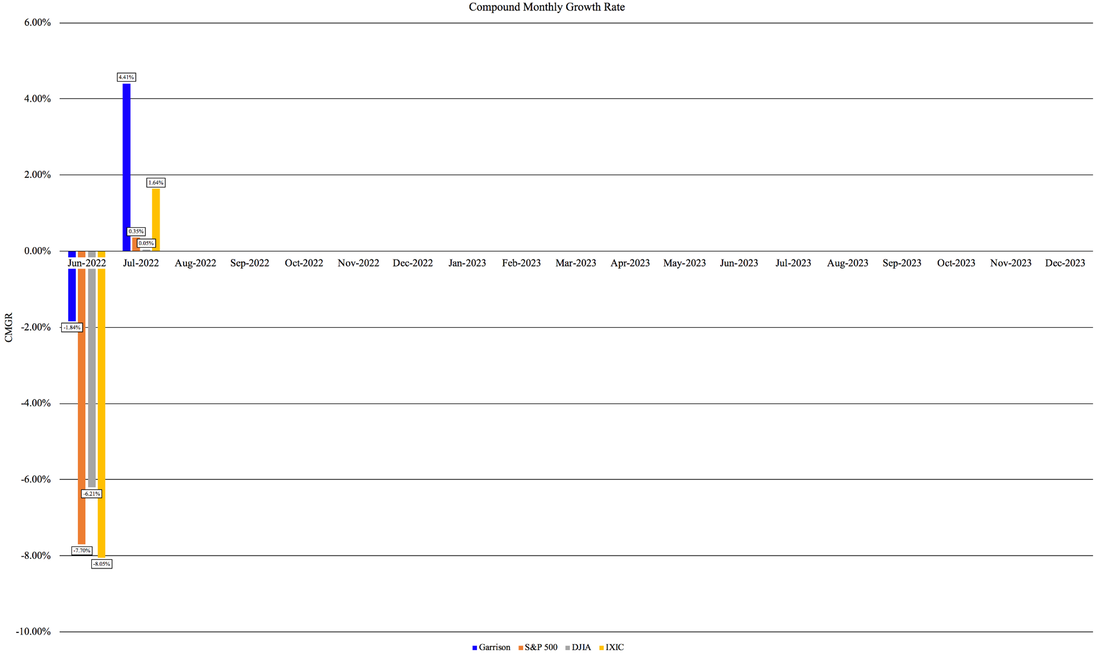

Garrison Fathom significantly beat the market in Q2 2022:

SP500: -16.73%

DJIA: -11.61%

NASDAQ: -22.67%

Garrison Fathom: +4.70%

Garrison Fathom’s long-term approach and investing in quality companies with great management teams, balance sheets, and products and/or services that people need and want – even during economic downturns, is nothing new. However, it’s our discipline and patience that outshines the rest of the market. Berkshire Hathaway and Vanguard are the few who do so as well.

REMINDER OF INVESTING PRINCIPLES

Contrary to popular belief, outperforming the market is not a sentiment or goal limited to higher yields on up days – the downside must also be protected against. The importance of this is twofold:

Q2 2022 MARKET RECAP

Q2 was a bloodbath for the market in general and the major indices in particular:

To say that the first half of 2022 has been volatile is even less insightful than to say water is wet, yet despite the media furor over continual losses, our Garrison portfolio has made good on its mission to defend invested capital regardless of broader market conditions.

Garrison Fathom significantly beat the market in Q2 2022:

SP500: -16.73%

DJIA: -11.61%

NASDAQ: -22.67%

Garrison Fathom: +4.70%

Garrison Fathom’s long-term approach and investing in quality companies with great management teams, balance sheets, and products and/or services that people need and want – even during economic downturns, is nothing new. However, it’s our discipline and patience that outshines the rest of the market. Berkshire Hathaway and Vanguard are the few who do so as well.

REMINDER OF INVESTING PRINCIPLES

Contrary to popular belief, outperforming the market is not a sentiment or goal limited to higher yields on up days – the downside must also be protected against. The importance of this is twofold:

- Short-term, massive gains are unsustainable. Everyone likes to see a large bump in share price when a company beats earnings, but these are not consistent events. No real-world economy is able to create an environment where repeated, consistent, outsized gains are possible: sooner or later, either competition will enter the arenas of the portfolio companies, stealing customers and slowing the growth of the portfolio companies; investors will realize gains and potentially create a glut of share sales, driving down the price; consumer sentiment will sour for reasons that have nothing to do with a company’s financials or operational efficiency; or demand will soften for reasons about which the average investor will remain ignorant and unable to control. Even when dealing with food, water, electricity, and waste management – inarguably the things without which modern society cannot exist – stocks do not close higher every single trading day.

Losses are inevitable. - Long-term is the only term that matters. So many investors are obsessed with quarterly earnings that one must wonder if they have cybernetic implants that prevent them from thinking on any other time scale. Earnings reports are useful for demonstrating how a company has reacted to broader market conditions, what management plan to do going forward, and to provide legally consequential evidence that, with regard to historical promises, they have quite literally put their money where their mouth is.

Q2 2022 MARKET RECAP

Q2 was a bloodbath for the market in general and the major indices in particular:

The causes for broader market downturn are as numerous as they are oft-repeated on every newscast day and night:

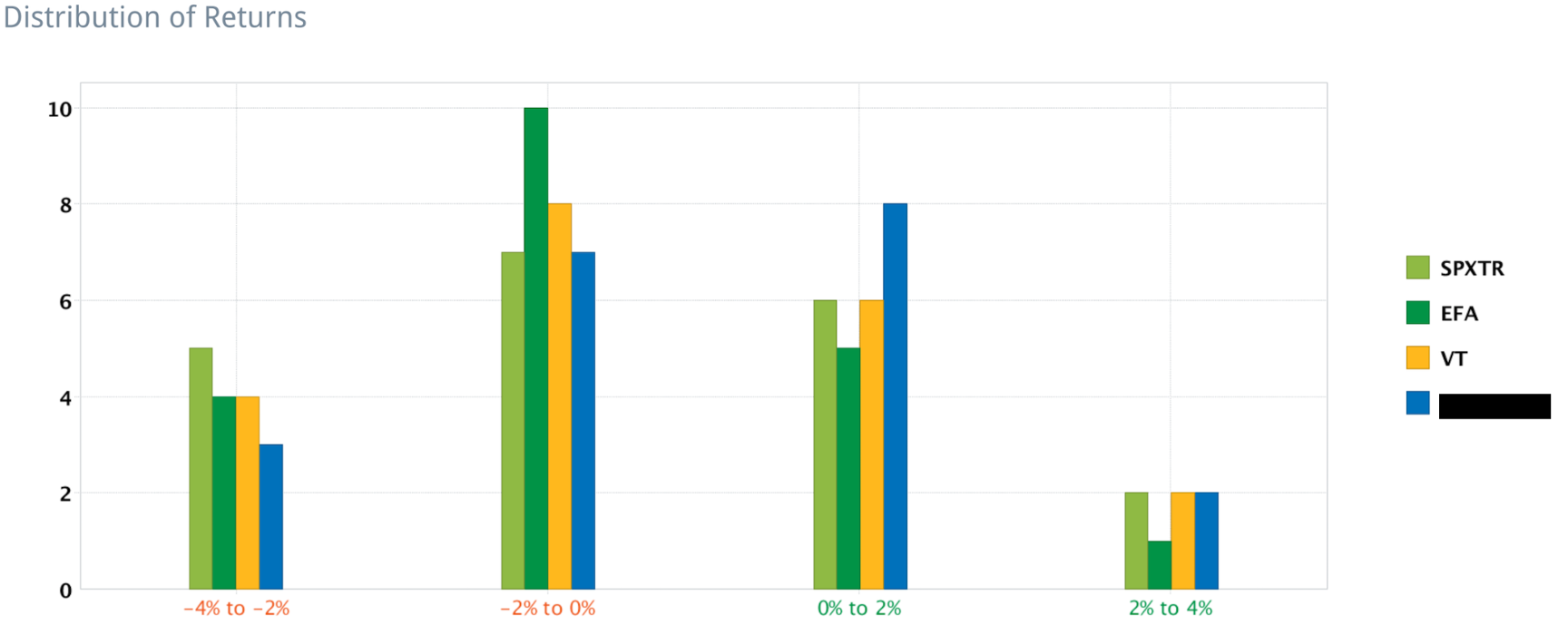

This is hardly the market condition where investing heavily into equities is top of mind, yet investors do themselves a great disservice by foregoing what in hindsight will likely be one of the 21st century’s most pronounced fire sales. The current volatility will likely be inconsequential in the long term, which as previously stated is the only term that truly matters. The key to constructing a portfolio that can consistently outperform “the market” (taken to be the major indices or their surrogate ETFs) is not so much trying to outdo the market’s upsides, but rather its downsides.

Stated another way – win small, but lose smaller:

- Increased volatility in oil and gas prices due to the ongoing Ukrainian conflict.

- Inflation continues to run amok with no signs of slowing.

- Uncertainty regarding whether or not the US will fall into recession (though many would argue that it already has).

- Continued shocks to the supply chain, including shortages of baby formula and the continued logistics unreliability in the semiconductor and electronics markets.

- Sharp declines in consumer savings rate.

- Consumer sentiment that has plummeted to levels not seen since 2008.

This is hardly the market condition where investing heavily into equities is top of mind, yet investors do themselves a great disservice by foregoing what in hindsight will likely be one of the 21st century’s most pronounced fire sales. The current volatility will likely be inconsequential in the long term, which as previously stated is the only term that truly matters. The key to constructing a portfolio that can consistently outperform “the market” (taken to be the major indices or their surrogate ETFs) is not so much trying to outdo the market’s upsides, but rather its downsides.

Stated another way – win small, but lose smaller:

The true ally of this strategy is time, which is ultimately the only metric by which a strategy’s performance can be measured.

GARRISON FATHOM’S LONG-TERM APPROACH & PATIENCE PAYS OFF, EVEN DURING POOR ECONOMIC CONDITIONS

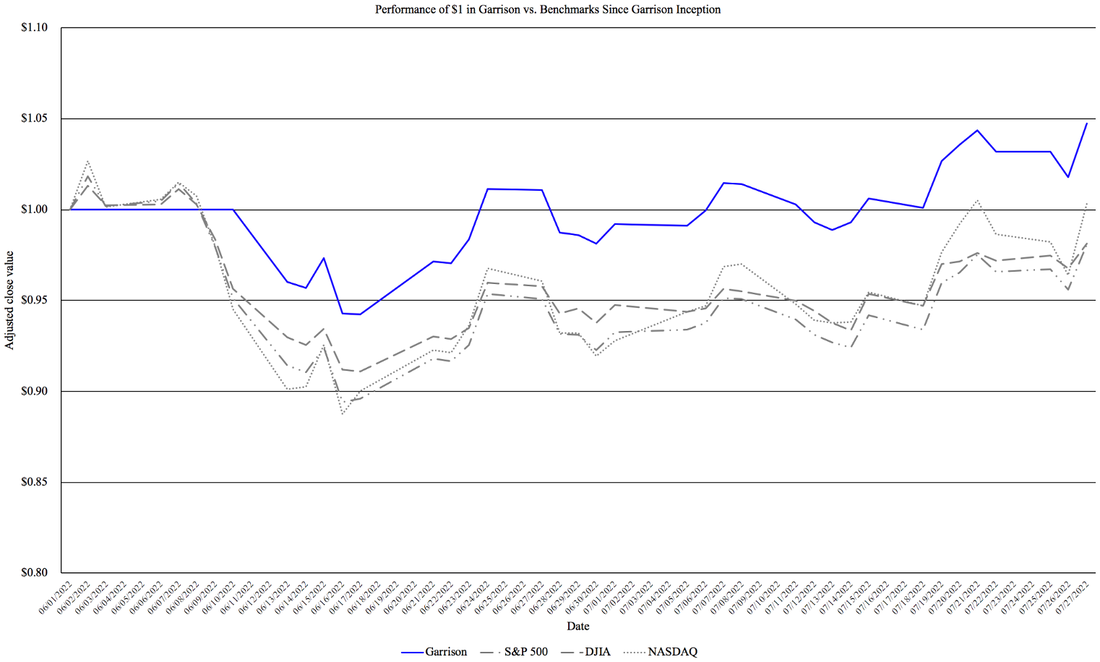

Constructing a portfolio to outperform indices even in down markets is not a profound revelation (it actually forms the basis for Sortino-based strategies), but this simple approach reinforces the fact that the price paid for large gains (in the form of large and/or consistent losses) is what dooms most trading strategies that stray too far from the “buy and hold ETFs” mentality. ETFs are of great value and utility to most investors, especially those that favor a passive strategy, but they cannot be the be-all, end-all of a minimum-downside approach because ETFs – especially those that are constructed to mirror a specific index, such as the S&P 500 – will by design include equities that are overvalued or simply destined for failure. While ETFs will serve the needs of the vast majority of passive investors, we aim to prove that the selection of specific companies, serving the undeniable basic needs of society, will consistently outperform indices over time. The performance of a single dollar invested in the Garrison portfolio to date begins to show the benefits of this strategy:

Constructing a portfolio to outperform indices even in down markets is not a profound revelation (it actually forms the basis for Sortino-based strategies), but this simple approach reinforces the fact that the price paid for large gains (in the form of large and/or consistent losses) is what dooms most trading strategies that stray too far from the “buy and hold ETFs” mentality. ETFs are of great value and utility to most investors, especially those that favor a passive strategy, but they cannot be the be-all, end-all of a minimum-downside approach because ETFs – especially those that are constructed to mirror a specific index, such as the S&P 500 – will by design include equities that are overvalued or simply destined for failure. While ETFs will serve the needs of the vast majority of passive investors, we aim to prove that the selection of specific companies, serving the undeniable basic needs of society, will consistently outperform indices over time. The performance of a single dollar invested in the Garrison portfolio to date begins to show the benefits of this strategy:

Understanding the basics is easy, but executing and remaining persistent to the basic core principles of investing is the hardest. We see this time and time again with the irresponsible actions by many, especially by speculators and undisciplined fund managers. I am proud of how we remain true to our principles and disciplined with patience. The results speak for themselves.

Vinh Vuong

CEO and Chairman, Garrison Fathom

We expect the remainder of 2022 to remain turbulent, but our portfolio will continue its momentum and maintain its consistent pace of growth. It is highly unlikely that the stressors that have caused so much volatility in the first half of the year will abate: supply chain issues remain far from resolved, inflation continues to grow despite somewhat anemic rate hikes by the Fed, and there seems to be little progress from regulators or government leaders that will provide immediate relief to Americans in general.

Short-term rallies this year will likely be nothing more than bull traps, and investors chase them at their own peril. Investing principles do not change regardless of externalities; the wise investor will beware articles promising safe havens from the inflationary storm – the simple fact is that there aren’t any, and whatever sector has not yet been hit by inflationary pressure or recessionary fears will be, sooner or later.

Willie Costa

COO and Vice Chairman, Garrison Fathom

Markets are extremely efficient at having public information priced in before the general populace can act on it, but historically have been horrendously incapable of allowing fundamentals-based investment strategies to go unrewarded.

The only way out of this mess is through it, and patience will win the day.

Subscribe to updates or if you have any questions or comments, please email us at: [email protected]

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom

The only way out of this mess is through it, and patience will win the day.

Subscribe to updates or if you have any questions or comments, please email us at: [email protected]

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom