Garrison Fathom Fund I Continues To Outperform Markets & Peers In Second Quarter of 2023:

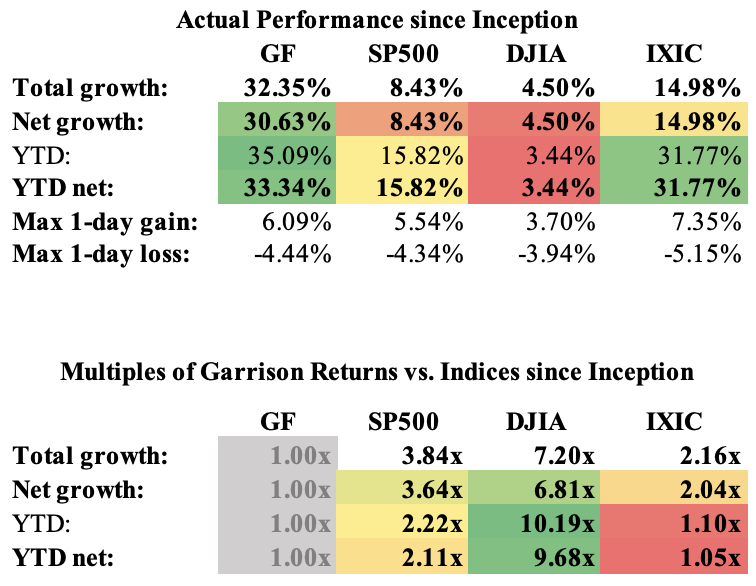

Portfolio up 34.99% YTD, 33.23% YTD net, and 32.25% net since inception

July 11, 2023

By Willie J. Costa & Vinh Q. Vuong

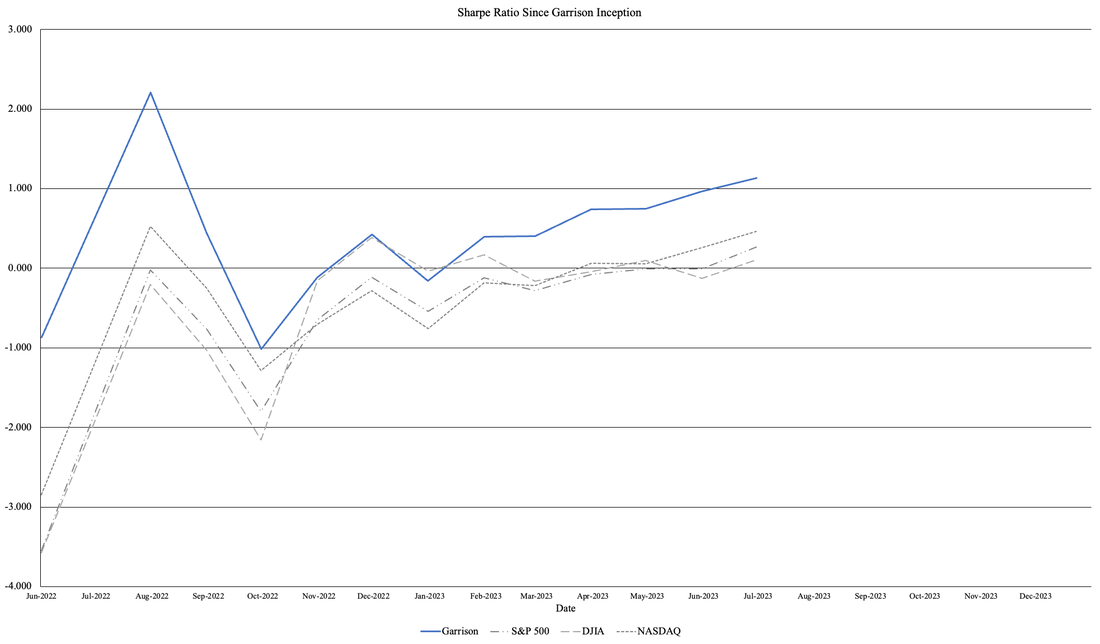

We are proud to say that we have finished the second quarter of 2023 at an all-time high for AUM, and our fund continues to demonstrate the sensibility of our Sharpe-maximized portfolio strategy, trouncing the indices in terms of total and risk-adjusted return. With the end of this quarter, we mark the culmination of the Garrison fund’s first year of continuous operation, and evidence continues to mount that our investment thesis is valid and applicable to real markets with real-world volatilities and uncertainties.

NVIDIA’s massive jump after their May earnings call provided an enjoyable boost to our portfolio’s performance, but as will be shown below this has been nothing more than a blip in the overall trend of the Garrison fund. That should in no way be interpreted as a slight against NVIDIA, as we foresee them remaining a leader and vicious competitor within the chip space – especially with respect to AI applications as well as enterprise-grade HPC (high-power computing) products, such as the U.S. Navy’s 180,000-core Nautilus supercomputer, which proudly relies on NVIDIA hardware.

Changes to portfolio allocations

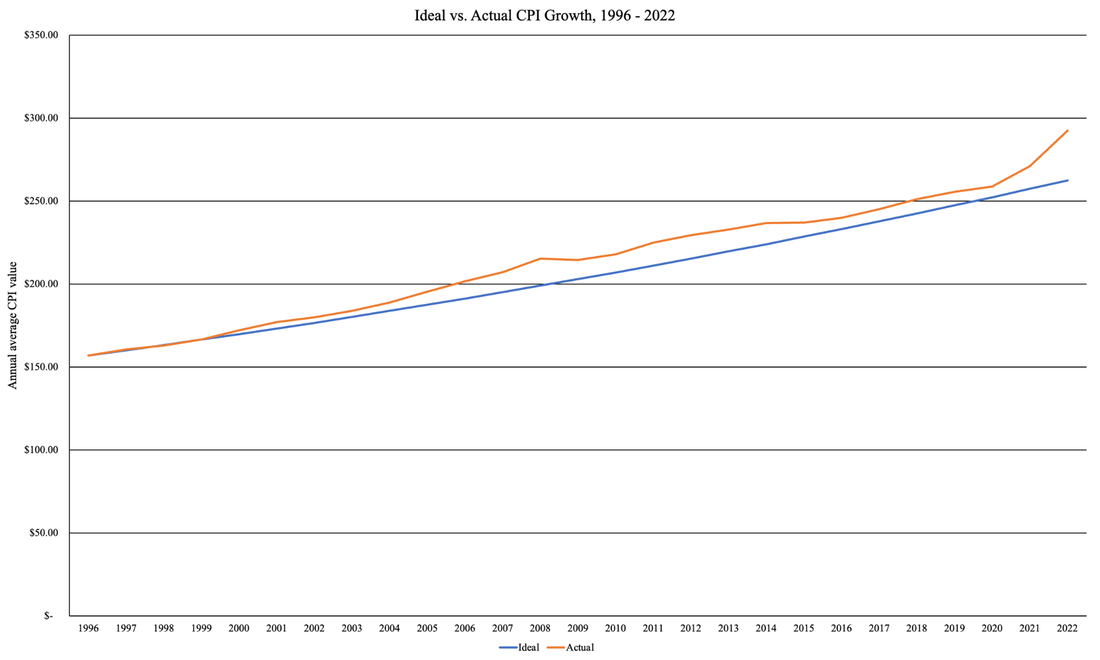

The risk of recession and uncertainty regarding raising the debt limit (which, as of the time of this writing, has been approved by the House; the Senate have yet to approve it) have not diminished, nor has the need to continue hiking rates in order to fight inflation. Thankfully, the rate hikes appear to be working, though we anticipate that at least another 1-1.5% of rate hikes will be necessary before inflation truly begins to get under control; we anticipate at least 0.50-0.75% of these hikes will occur throughout the rest of 2023, and – barring any exogenous shocks – will likely continue until Q2 of 2024.

To that end, we have begun investing in short-term Treasury bills to take advantage of the still-inverted yield curve, and will be rolling these forward throughout the rest of 2023. To date we have paid particularly close attention to the four-week T-bill, although with the threat of default no longer looming quite as large as before (thanks to an eleventh-hour debt ceiling agreement, although we feel this “resolution” was nothing more than a patch that will affect no meaningful change in government spending, and which will leave the country in the exact same mess in two years’ time); we believe it may be necessary to look at the eight-week T-bill as well for a roll-forward strategy.

The debt deal will undeniably continue to affect markets, given that very little of the agreement has been substantive (concessions and spending cuts amounting to approximately 0.2% of GDP in 2024 and another 0.1% in 2025, along with job losses on the order of 250,000). The overall impact of this political posturing can politely be termed a nothingburger that will have next to zero impact on the economy. This means that the pains of 2023 will likely reappear in 2025; functionally speaking, the debt deal can easily be ignored in favor of focusing on the monetary policies that will actually impact the economy and thus our portfolio. We must also remember that inflation has not ceased being problematic, regardless of Chair Powell’s decision to momentarily pause rate hikes; as mentioned, we are still well above the desired inflation target, and it is still likely that the market run-up to close out the quarter is a more likely sign of a melt-up than true economic stabilization.

We continue to examine opportunities in the industrials and agriculture sectors, but for the time being we will not be deploying any additional capital. While it’s impossible to time the market, it’s also plain as day that unless and until inflation comes under control, the bottom is still a looming threat.

Garrison fund performance

Garrison has returned 32.25% net since inception, along with 33.23% net YTD. This is almost four times the growth of the S&P during the same period; net year to date returns are more than twice the S&P and more than eight times the Dow. Return performance has been on par with the NASDAQ Composite Index, undoubtedly due to the weighting of the Garrison portfolio with fundamental technology stocks. Our maximum single-day gain so far has been 6.09% (which was actually not due to the jump in NVIDIA stock), which trails the NASDAQ’s 7.35% single-day gain (which was also not related to the NVIDIA jump, as the NASDAQ actually lost 0.61% on that day).

By Willie J. Costa & Vinh Q. Vuong

We are proud to say that we have finished the second quarter of 2023 at an all-time high for AUM, and our fund continues to demonstrate the sensibility of our Sharpe-maximized portfolio strategy, trouncing the indices in terms of total and risk-adjusted return. With the end of this quarter, we mark the culmination of the Garrison fund’s first year of continuous operation, and evidence continues to mount that our investment thesis is valid and applicable to real markets with real-world volatilities and uncertainties.

NVIDIA’s massive jump after their May earnings call provided an enjoyable boost to our portfolio’s performance, but as will be shown below this has been nothing more than a blip in the overall trend of the Garrison fund. That should in no way be interpreted as a slight against NVIDIA, as we foresee them remaining a leader and vicious competitor within the chip space – especially with respect to AI applications as well as enterprise-grade HPC (high-power computing) products, such as the U.S. Navy’s 180,000-core Nautilus supercomputer, which proudly relies on NVIDIA hardware.

Changes to portfolio allocations

The risk of recession and uncertainty regarding raising the debt limit (which, as of the time of this writing, has been approved by the House; the Senate have yet to approve it) have not diminished, nor has the need to continue hiking rates in order to fight inflation. Thankfully, the rate hikes appear to be working, though we anticipate that at least another 1-1.5% of rate hikes will be necessary before inflation truly begins to get under control; we anticipate at least 0.50-0.75% of these hikes will occur throughout the rest of 2023, and – barring any exogenous shocks – will likely continue until Q2 of 2024.

To that end, we have begun investing in short-term Treasury bills to take advantage of the still-inverted yield curve, and will be rolling these forward throughout the rest of 2023. To date we have paid particularly close attention to the four-week T-bill, although with the threat of default no longer looming quite as large as before (thanks to an eleventh-hour debt ceiling agreement, although we feel this “resolution” was nothing more than a patch that will affect no meaningful change in government spending, and which will leave the country in the exact same mess in two years’ time); we believe it may be necessary to look at the eight-week T-bill as well for a roll-forward strategy.

The debt deal will undeniably continue to affect markets, given that very little of the agreement has been substantive (concessions and spending cuts amounting to approximately 0.2% of GDP in 2024 and another 0.1% in 2025, along with job losses on the order of 250,000). The overall impact of this political posturing can politely be termed a nothingburger that will have next to zero impact on the economy. This means that the pains of 2023 will likely reappear in 2025; functionally speaking, the debt deal can easily be ignored in favor of focusing on the monetary policies that will actually impact the economy and thus our portfolio. We must also remember that inflation has not ceased being problematic, regardless of Chair Powell’s decision to momentarily pause rate hikes; as mentioned, we are still well above the desired inflation target, and it is still likely that the market run-up to close out the quarter is a more likely sign of a melt-up than true economic stabilization.

We continue to examine opportunities in the industrials and agriculture sectors, but for the time being we will not be deploying any additional capital. While it’s impossible to time the market, it’s also plain as day that unless and until inflation comes under control, the bottom is still a looming threat.

Garrison fund performance

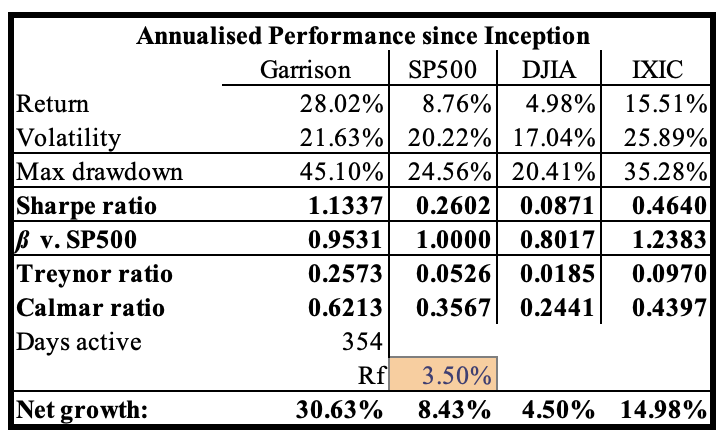

Garrison has returned 32.25% net since inception, along with 33.23% net YTD. This is almost four times the growth of the S&P during the same period; net year to date returns are more than twice the S&P and more than eight times the Dow. Return performance has been on par with the NASDAQ Composite Index, undoubtedly due to the weighting of the Garrison portfolio with fundamental technology stocks. Our maximum single-day gain so far has been 6.09% (which was actually not due to the jump in NVIDIA stock), which trails the NASDAQ’s 7.35% single-day gain (which was also not related to the NVIDIA jump, as the NASDAQ actually lost 0.61% on that day).

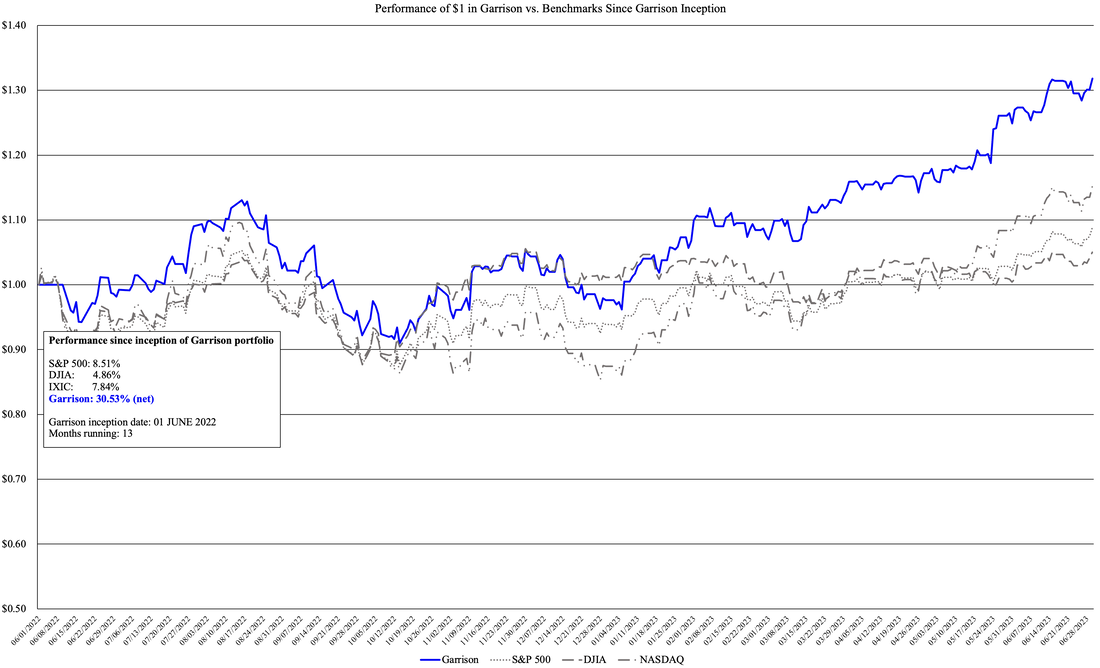

Since inception, every dollar invested in Garrison would be worth $1.32 as of market close on 30 June 2023. By comparison, every dollar invested in the S&P, Dow, or NASDAQ during the same period would only be worth $1.09, $1.05, and $1.15, respectively. As seen in the time series of returns, our Garrison strategy is beginning to show its long-term superiority over the indices.

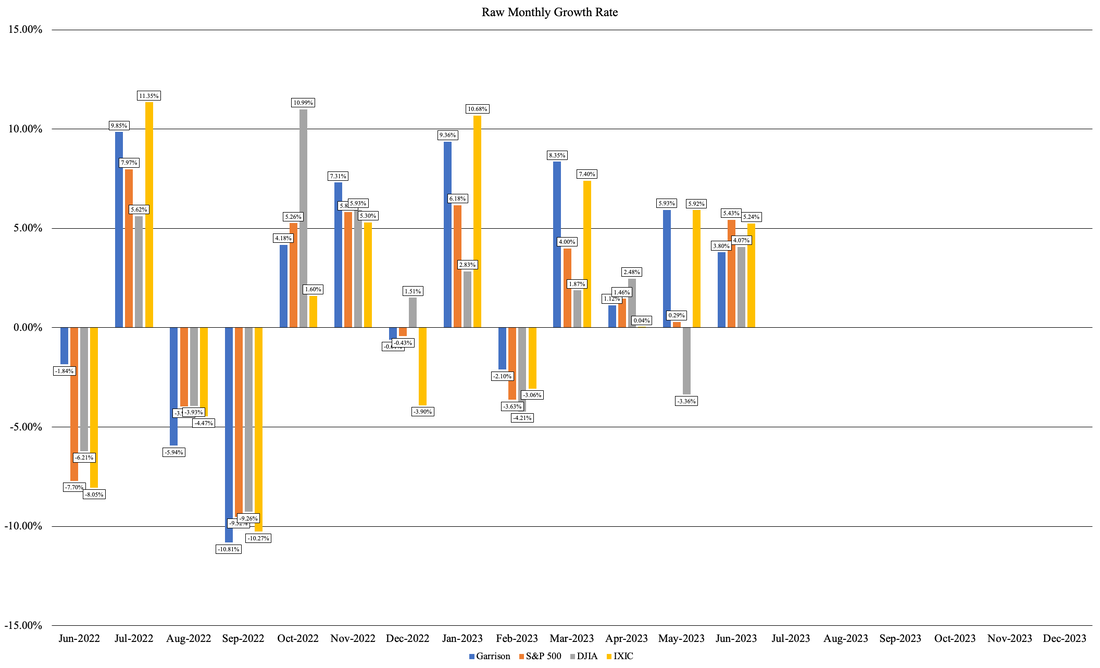

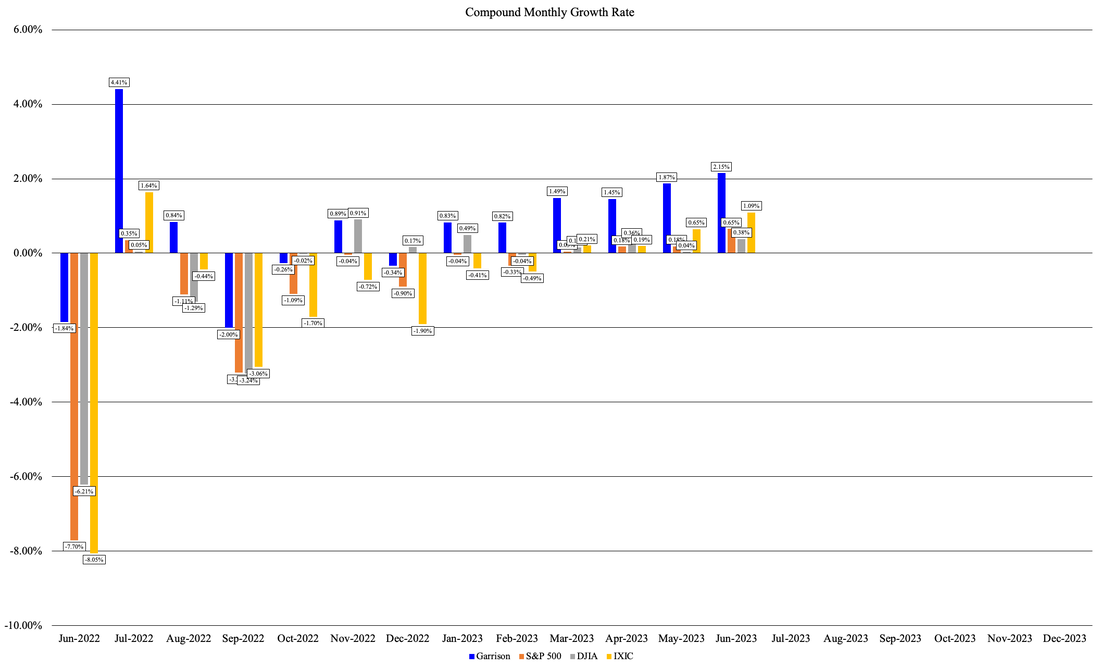

“Slow and steady wins the race” continues to apply on a monthly raw and compound growth basis. As shown below, there is clear value in focusing on maximizing risk-adjusted returns rather than total returns: Garrison doesn’t always “win big” against the indices, but consistently applying the philosophy of “win small, lose smaller” begins to show its advantages. Our current compound monthly growth rate of 2.15% is several times higher than that of the indices: the CMGR of the S&P, Dow, and NASDAQ are currently 0.65%, 0.38%, and 1.09%, respectively.

The focus on Sharpe optimization and risk management continues to show superiority over a traditional basket-of-funds approach. Garrison’s Sharpe ratio is 1.136 as of the end of the quarter, and our Sortino ratio has reached a value of 1.50; note that the Sortino ratio has actually approached a value of 2 during intra-quarter market actions, but as we are only concerned with the traditional milestones of month-end, quarter-end, and year-end results, these intra-month spikes are of little concern here.

As always, our complete IBKR report containing metrics and performance since inception is available to prospective investors, and will be updated quarterly.

Our performance ratios versus the indices are shown below.

We continue to hold 3.50% as the long-term risk-free rate as we believe that the current interest rate environment is transitory, and if Chair Powell continues attacking inflation we feel it is a conservative assumption to assume that the reference rates will revert to historical norms within the next five years.

Our performance ratios versus the indices are shown below.

We continue to hold 3.50% as the long-term risk-free rate as we believe that the current interest rate environment is transitory, and if Chair Powell continues attacking inflation we feel it is a conservative assumption to assume that the reference rates will revert to historical norms within the next five years.

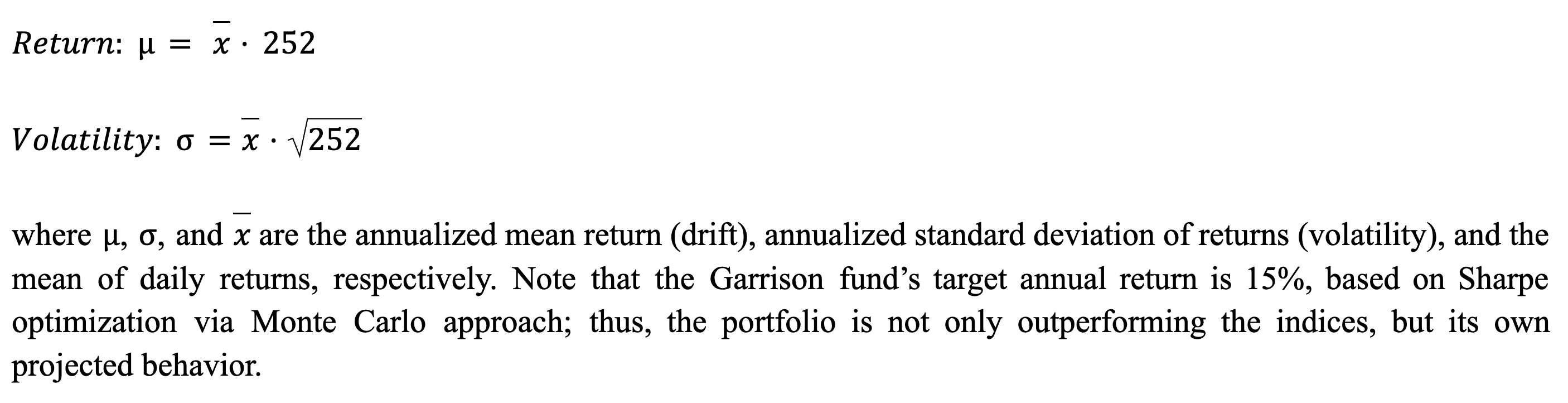

The annualized figures given above are estimates given the daily returns of the Garrison portfolio versus the indices, and as such will not necessarily match the actual performance numbers given previously. Annualized performance is calculated as follows:

Closing thoughts and future outlook

The current interest rate environment can potentially present workable opportunities to move into fixed-income positions, especially with long-dated, non-callable corporate bonds. We will begin examining these opportunities in earnest while still investing in rolling short-term T-bills. We still see a significant possibility of recession within the second half of 2023 or first half of 2024, and as mentioned we believe at least another 1-1.5% of rate hikes from now until the end of 2024 will be the minimum necessary to continue making meaningful progress against inflation. This is one of the reasons why we have not moved into fixed-income positions yet: we expect rates to continue trending higher, thus making Treasury bills and non-callable bonds more attractive.

We do not foresee a need to increase our equity positions for the duration of 2023, and as such the Garrison portfolio will likely remain relatively unchanged. Should the macroeconomic environment substantially change (which, again, we feel is unlikely), we will re-examine our stance on moving into other positions, or we may increase our holdings in the current portfolio and take advantage of dollar-cost averaging of per-share costs. The overall performance of the fund remains the optimization target, not necessarily the fund’s position within any specific equity.

While this update denotes the end of our fund’s first full year of performance, for the sake of convenience and clarity we will begin measuring fund performance based on calendar year for quarterly and YTD figures, but will retain the “since-inception” metrics as they are. This will allow a more direct and clear comparison between Garrison and the indices or other comparison funds of interest to our audience.

The current interest rate environment can potentially present workable opportunities to move into fixed-income positions, especially with long-dated, non-callable corporate bonds. We will begin examining these opportunities in earnest while still investing in rolling short-term T-bills. We still see a significant possibility of recession within the second half of 2023 or first half of 2024, and as mentioned we believe at least another 1-1.5% of rate hikes from now until the end of 2024 will be the minimum necessary to continue making meaningful progress against inflation. This is one of the reasons why we have not moved into fixed-income positions yet: we expect rates to continue trending higher, thus making Treasury bills and non-callable bonds more attractive.

We do not foresee a need to increase our equity positions for the duration of 2023, and as such the Garrison portfolio will likely remain relatively unchanged. Should the macroeconomic environment substantially change (which, again, we feel is unlikely), we will re-examine our stance on moving into other positions, or we may increase our holdings in the current portfolio and take advantage of dollar-cost averaging of per-share costs. The overall performance of the fund remains the optimization target, not necessarily the fund’s position within any specific equity.

While this update denotes the end of our fund’s first full year of performance, for the sake of convenience and clarity we will begin measuring fund performance based on calendar year for quarterly and YTD figures, but will retain the “since-inception” metrics as they are. This will allow a more direct and clear comparison between Garrison and the indices or other comparison funds of interest to our audience.

Subscribe to updates or if you have any questions or comments, please email us at: [email protected]

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom