Contraction in Third Quarter of 2023, Garrison Fathom Still Leads Benchmarks:

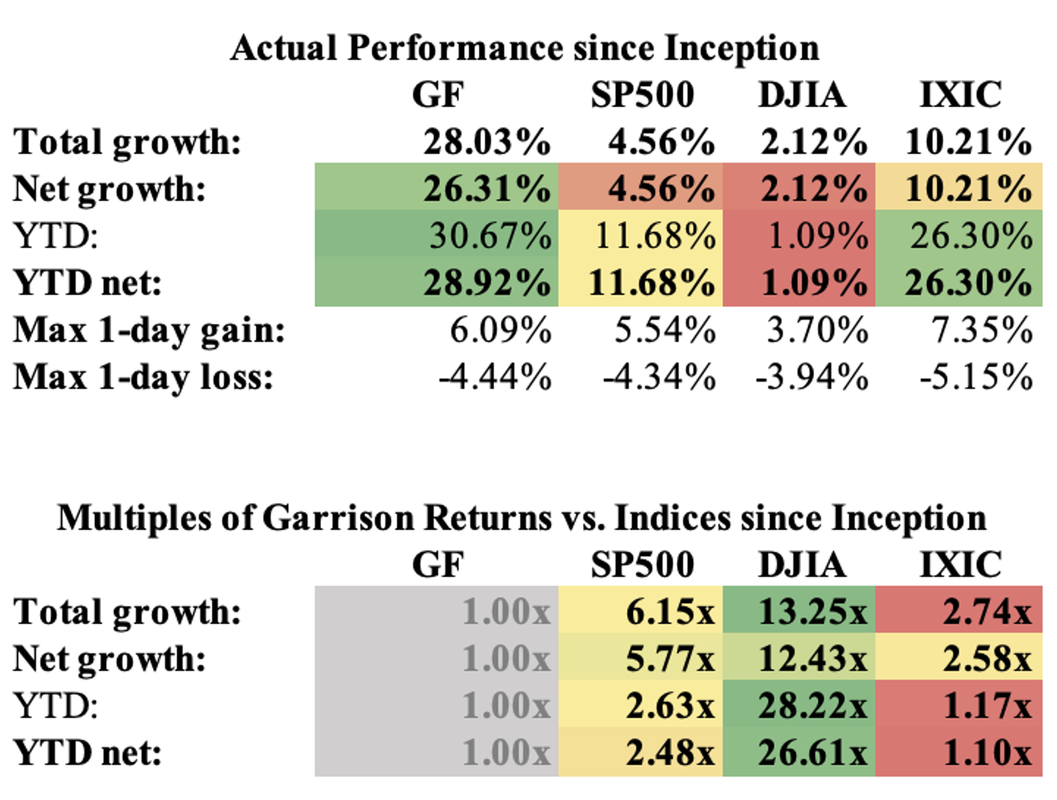

Garrison portfolio up 30.67% YTD, 28.92% YTD net, and 26.31% net since inception

October 12, 2023

By Willie J. Costa & Vinh Q. Vuong

There is no question that the third quarter has been rough for the market in general, though Garrison’s position remains strong relative to the market indices. Much of this contraction was driven by the decline in share price of NVIDIA – profit-taking is a likely cause, although a raid by French authorities undoubtedly contributed. The former is expected, and the latter is of little concern given the specifics of the action: viz. France’s competition authority is currently investigating several cloud computing companies regarding whether they are using their market power to exclude smaller competitors; NVIDIA was simply the largest and most well-known of the companies targeted. We will continue to monitor the situation closely and take appropriate action regarding our positions. Our confidence in similar tech companies (Apple, Google, Microsoft) that Garrison Fathom holds remains strong and long-term.

Changes to portfolio allocations

We have taken a position in Itochu (8001.T) at an average cost of ¥5763.6 ($38.58USD). Itochu is an industrial conglomerate engaging in the trade and import/export of various products, including textiles (garment materials, textile fabrics, industrial materials, lifestyle brands and fashion accessories, etc.), machinery (including engineering, procurement, and construction services), and metals & mining. The company is well-diversified amongst several sectors, including luxury goods, oil and gas, petrochemical, water and environmental processing, infrastructure, renewable energy, automobiles, iron ore, coal, uranium, base metals, non-ferrous metals, charter ships, food, paper, pulp, natural rubber, wood products, and even real estate operations and IT. We feel this company is well-positioned to ride out most market moves as it provides not only normal goods but also staples of everyday life. This position also marks the first time we have taken a position in a foreign company denominated in a foreign currency, and we will investigate the need to add forex analysis into our risk assessment.

Garrison fund performance

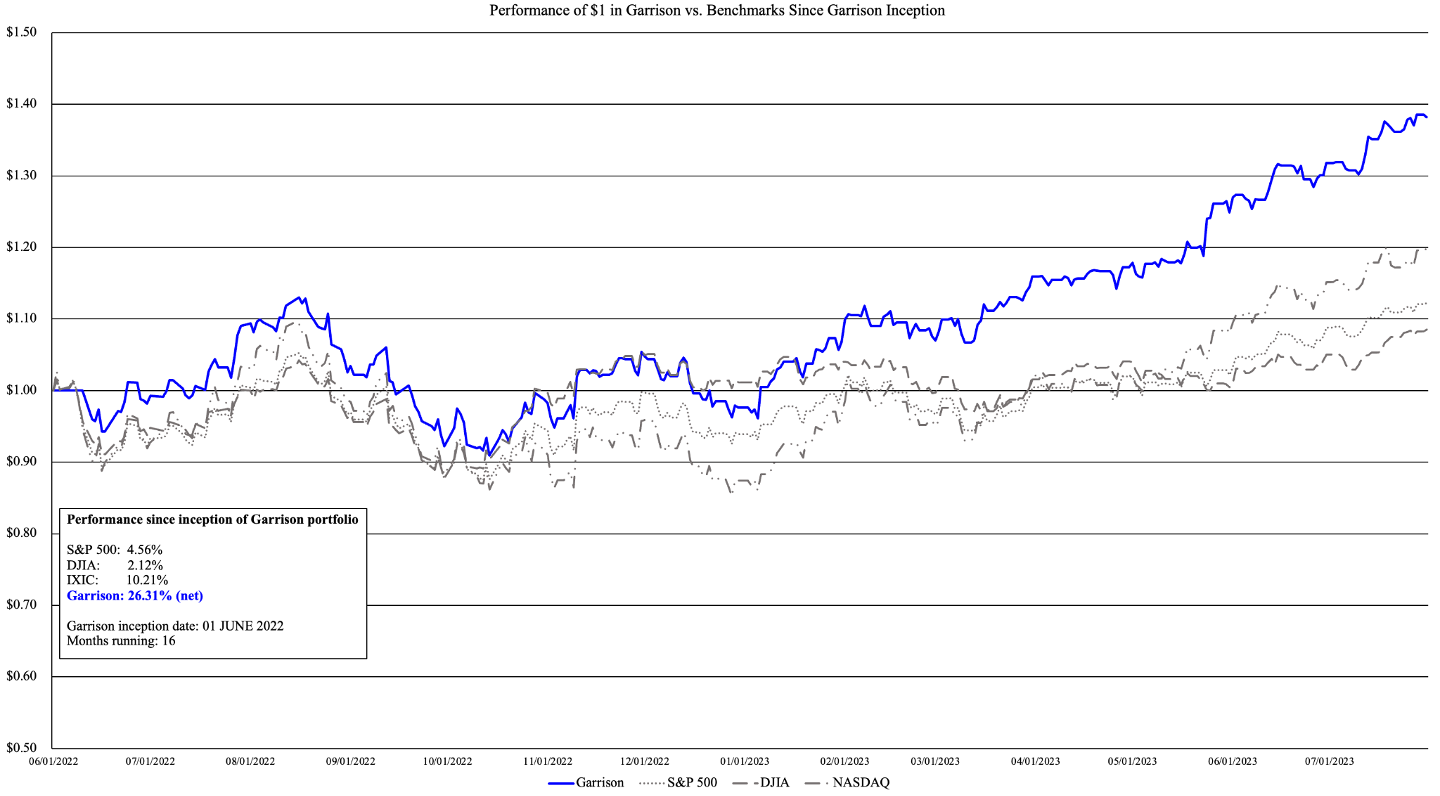

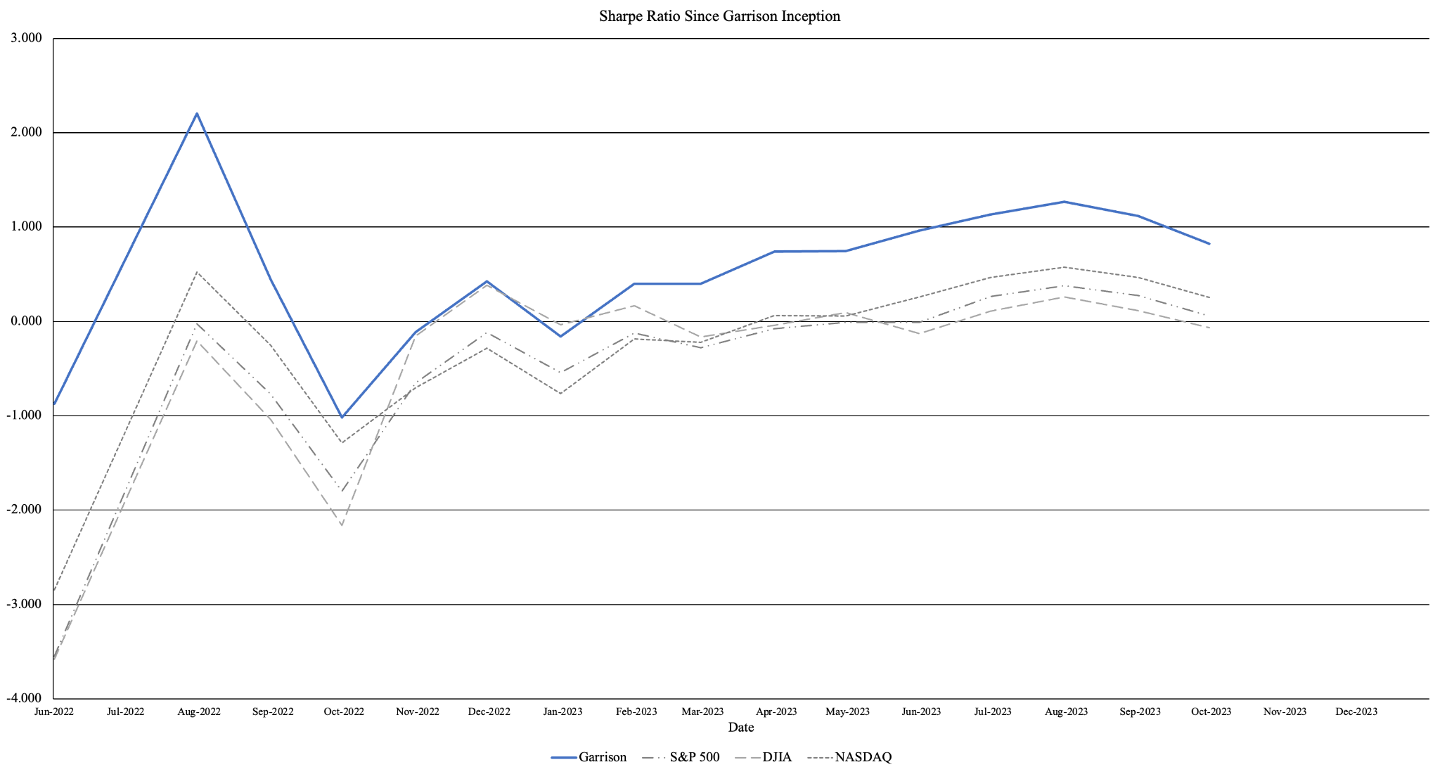

The performance of Garrison versus the indices is shown below. Despite the September contraction, we are still outperforming the indices and continue to show adequate long-term performance due to our investment strategy.

By Willie J. Costa & Vinh Q. Vuong

There is no question that the third quarter has been rough for the market in general, though Garrison’s position remains strong relative to the market indices. Much of this contraction was driven by the decline in share price of NVIDIA – profit-taking is a likely cause, although a raid by French authorities undoubtedly contributed. The former is expected, and the latter is of little concern given the specifics of the action: viz. France’s competition authority is currently investigating several cloud computing companies regarding whether they are using their market power to exclude smaller competitors; NVIDIA was simply the largest and most well-known of the companies targeted. We will continue to monitor the situation closely and take appropriate action regarding our positions. Our confidence in similar tech companies (Apple, Google, Microsoft) that Garrison Fathom holds remains strong and long-term.

Changes to portfolio allocations

We have taken a position in Itochu (8001.T) at an average cost of ¥5763.6 ($38.58USD). Itochu is an industrial conglomerate engaging in the trade and import/export of various products, including textiles (garment materials, textile fabrics, industrial materials, lifestyle brands and fashion accessories, etc.), machinery (including engineering, procurement, and construction services), and metals & mining. The company is well-diversified amongst several sectors, including luxury goods, oil and gas, petrochemical, water and environmental processing, infrastructure, renewable energy, automobiles, iron ore, coal, uranium, base metals, non-ferrous metals, charter ships, food, paper, pulp, natural rubber, wood products, and even real estate operations and IT. We feel this company is well-positioned to ride out most market moves as it provides not only normal goods but also staples of everyday life. This position also marks the first time we have taken a position in a foreign company denominated in a foreign currency, and we will investigate the need to add forex analysis into our risk assessment.

Garrison fund performance

The performance of Garrison versus the indices is shown below. Despite the September contraction, we are still outperforming the indices and continue to show adequate long-term performance due to our investment strategy.

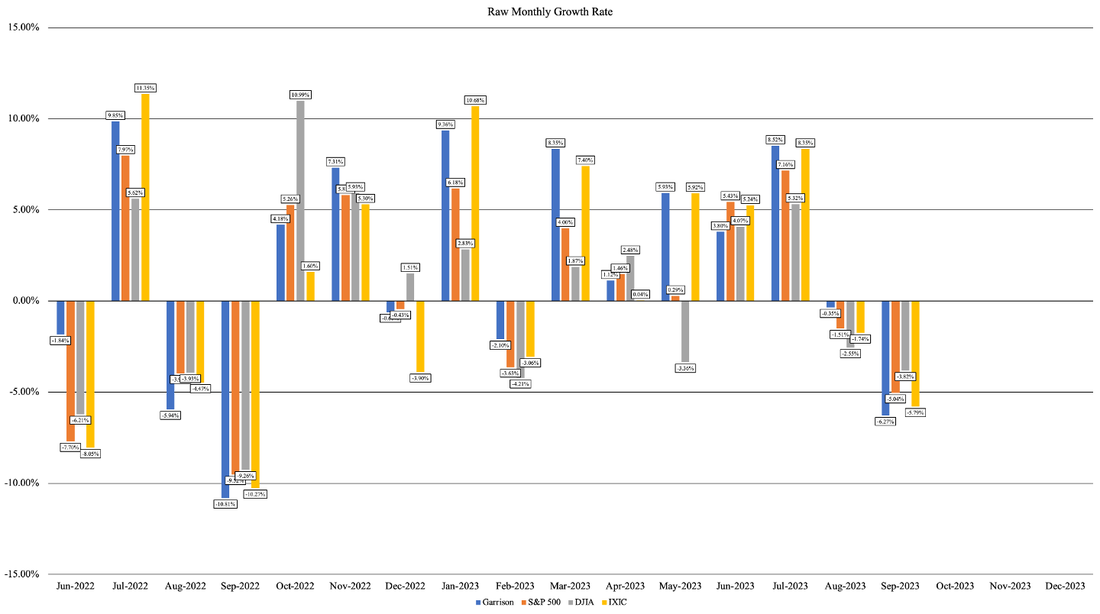

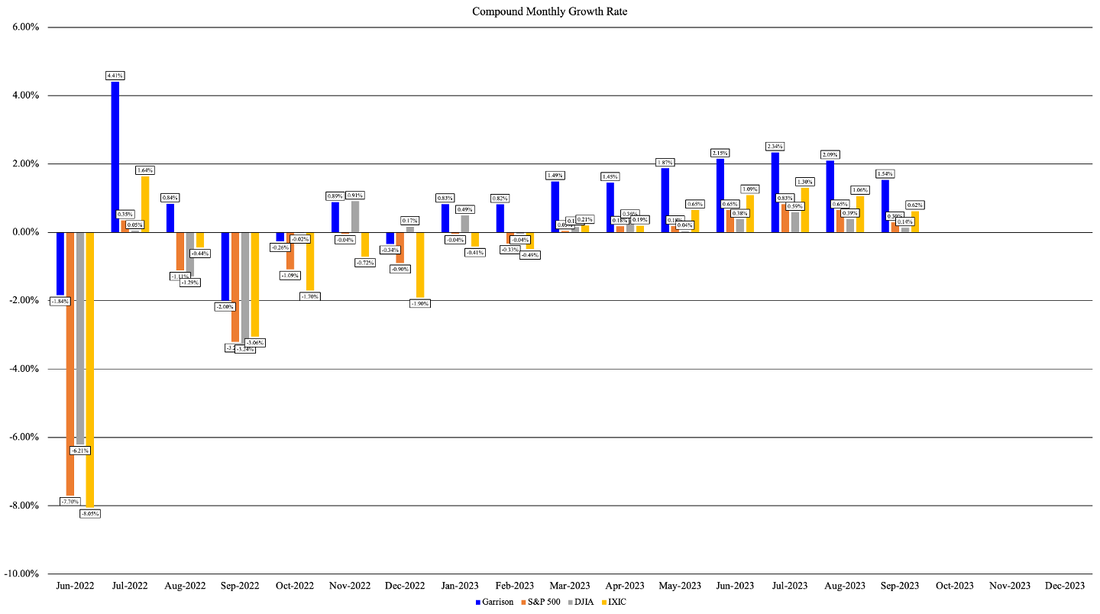

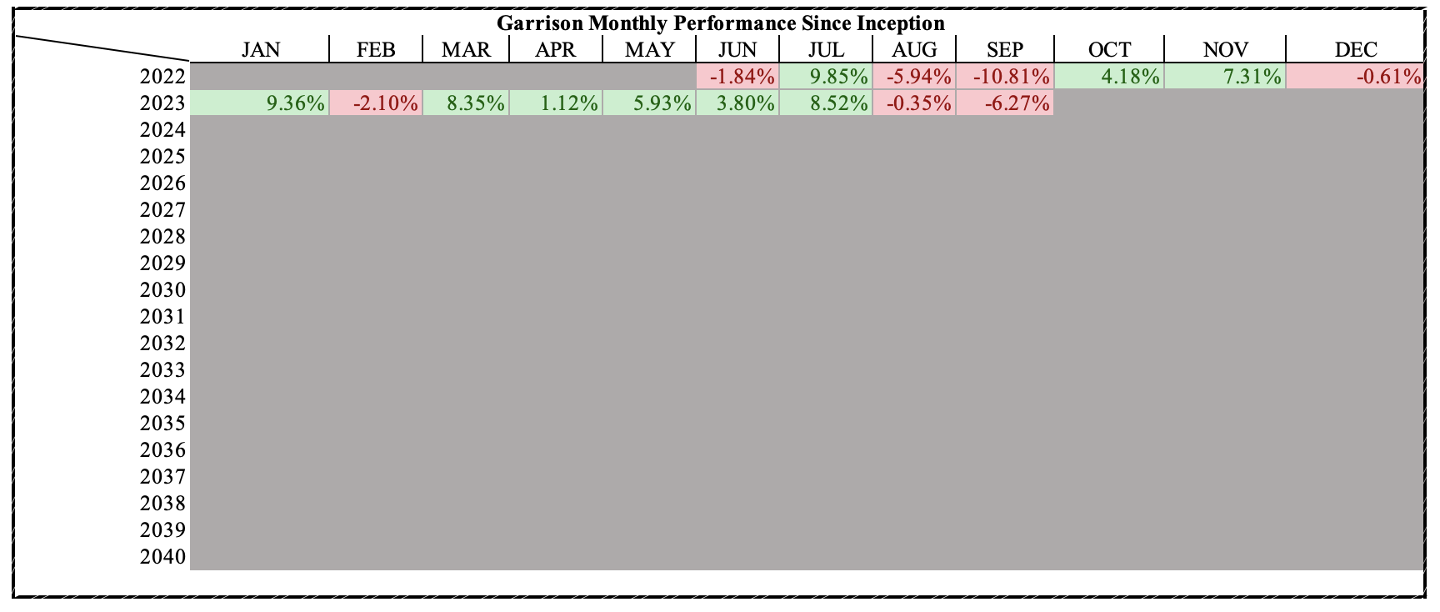

While our raw monthly growth rate was negative for August and September (primarily driven by the NVIDIA issues already discussed), our compound monthly growth rate remains strong and remains well above the indices in scale and consistency.

Similarly, our Sharpe ratio remains above the indices as well as above the long-term S&P average.

It should be noted that August and September contractions are not unique to 2023, as shown below. There is currently insufficient data on the performance history of the Garrison portfolio to apply this information in a meaningful manner, and is presented for the sake of completeness. This behavior may or may not inform future strategic decisions in fund positions, but we reiterate that we are not a trend-following or momentum-trading fund; therefore, while historical monthly trends such as those shown below are informative, they will not meaningfully impact the Garrison philosophy or fund management principles.

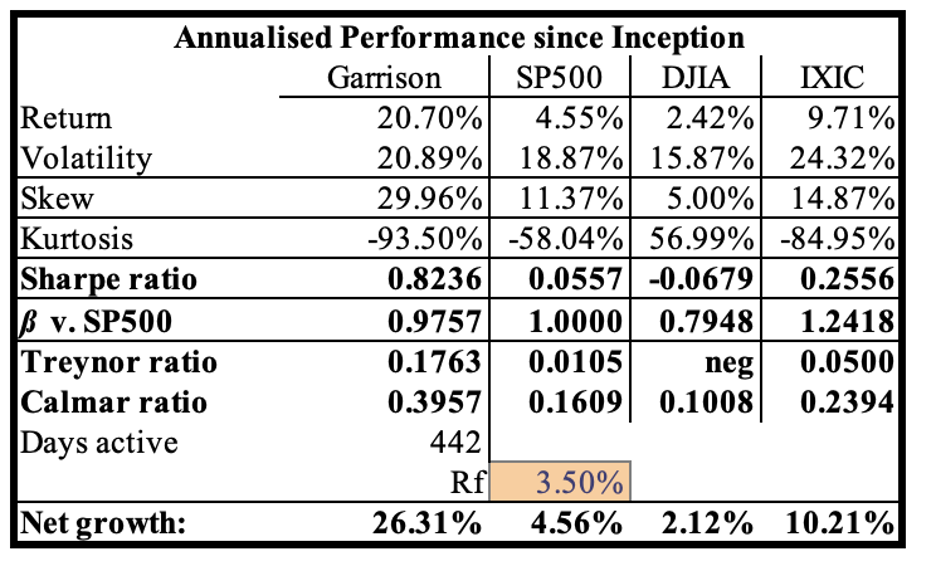

Our performance ratios versus the indices are shown below. We remain pleased with the performance of the Garrison portfolio despite broader market turbulence.

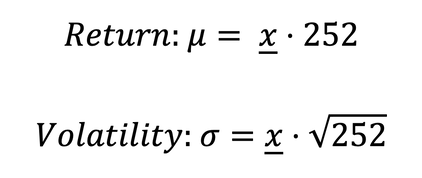

The annualized figures given above are estimates given the daily returns of the Garrison portfolio versus the indices, and as such will not necessarily match the actual performance numbers given previously. Annualized performance is calculated as follows:

where μ, σ, and ▁x are the annualized mean return (drift), annualized standard deviation of returns (volatility), and the mean of daily returns, respectively. Note that the Garrison fund’s target annual return is 15%, based on Sharpe optimization via Monte Carlo approach; thus, the portfolio is not only outperforming the indices, but its own projected behavior.

As always, our complete IBKR report containing metrics and performance since inception is available to prospective investors, and will be updated quarterly.

Closing thoughts and future outlook

We still do not foresee a need to increase our equity positions for the duration of 2023, and as such the Garrison portfolio will likely remain relatively unchanged. The overall performance of the fund remains the optimization target, and the fund continues to perform within allowable tolerances. We are currently preparing to perform our annual portfolio rebalancing and are looking into reducing our positions in some of the more volatile equities (e.g. tech) in favor of increased positions in consumer staples such as food, beverage, and energy.

We do not foresee the economy escaping a recession, but the exact timing and magnitude of an economic downturn remain inevitable; we estimate that economic slowing will occur through the end of 2023 and first half of 2024, driven primarily by energy prices and continued Fed hesitation to take a firm stance on interest rates to control inflation. While headline inflation has decreased, component inflation (especially in medical care commodities, shelter, rent, food, and transportation services) remains significantly higher than headline inflation on a year-on-year basis. Crude oil prices are also expected to increase consumer prices (and subsequently profitability for oil companies Garrison Fathom holds such as Chevron and Oxy) and adversely impact consumer spending.

We will therefore examine rebalancing the Garrison portfolio toward more defensive stocks based on these factors.

As always, our complete IBKR report containing metrics and performance since inception is available to prospective investors, and will be updated quarterly.

Closing thoughts and future outlook

We still do not foresee a need to increase our equity positions for the duration of 2023, and as such the Garrison portfolio will likely remain relatively unchanged. The overall performance of the fund remains the optimization target, and the fund continues to perform within allowable tolerances. We are currently preparing to perform our annual portfolio rebalancing and are looking into reducing our positions in some of the more volatile equities (e.g. tech) in favor of increased positions in consumer staples such as food, beverage, and energy.

We do not foresee the economy escaping a recession, but the exact timing and magnitude of an economic downturn remain inevitable; we estimate that economic slowing will occur through the end of 2023 and first half of 2024, driven primarily by energy prices and continued Fed hesitation to take a firm stance on interest rates to control inflation. While headline inflation has decreased, component inflation (especially in medical care commodities, shelter, rent, food, and transportation services) remains significantly higher than headline inflation on a year-on-year basis. Crude oil prices are also expected to increase consumer prices (and subsequently profitability for oil companies Garrison Fathom holds such as Chevron and Oxy) and adversely impact consumer spending.

We will therefore examine rebalancing the Garrison portfolio toward more defensive stocks based on these factors.

Subscribe to updates or if you have any questions or comments, please email us at: [email protected]

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom

Follow our CEO: @thevinhvuong

Follow Garrison Fathom: @garrisonfathom