Garrison Fathom trounces S&P 500 performance for 2023

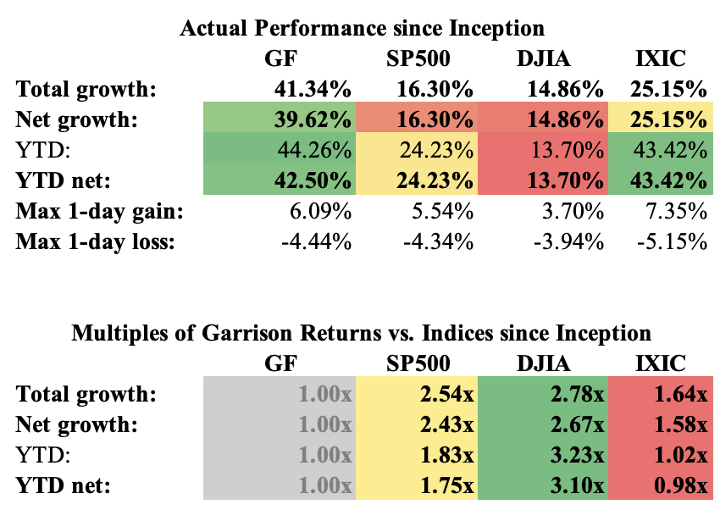

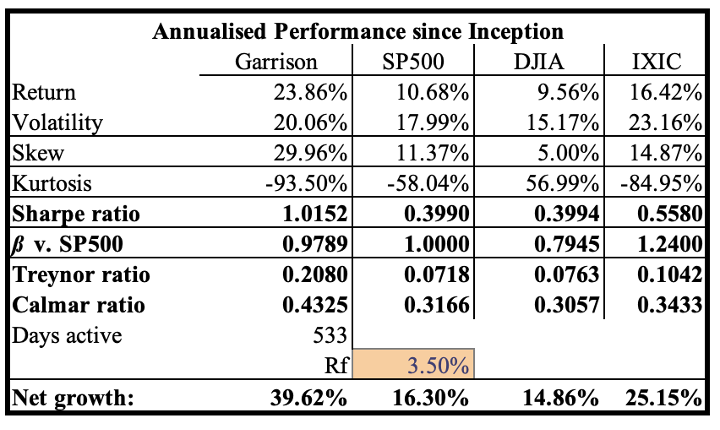

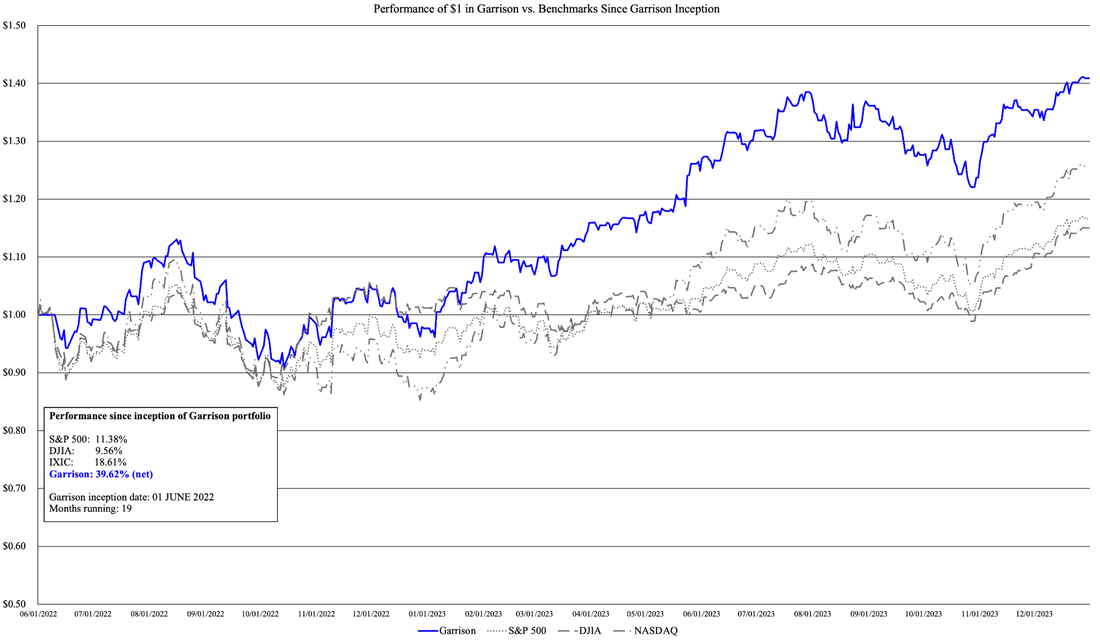

Garrison Fathom’s Fund I portfolio ended 2023 up +44.26% (42.50% net), and 39.652% net since inception. CAGR at 25.94%.

January 9, 2024

By Willie J. Costa & Vinh Q. Vuong

The S&P 500 closed 2023 at +24.23%, the highest since the pre-tech bubble euphoria of 1999. Garrison Fathom’s Garrison Fund I (GF-I), meanwhile, finished the year +42.50% net, or about 1.75 times the return of the S&P.

Chalk one up for the merits of long-term value investing.

What did markets get right? According to The Wall Street Journal, not a whole lot. Ordinary logic would have called 2023 a bear’s dream: the Federal Reserve hiked rates at the fastest rate since Volcker saved the country from entrenched and willful ignorance in the 1980s, Silicon Valley Bank proved that no management strategy was so terrible that it couldn’t be topped by an even worse one, and war broke out in the Middle East yet again.

But stocks continued to climb. Does that mean that doom has been averted? Hardly: as we’ve mentioned in our podcast, you need to look behind the numbers to see what’s actually going on – no small task given that a stock market “melt-up” is the scenario no one wants to imagine. For instance, despite the Biden administration’s (wholly premature) celebration over “defeating” inflation, all CPI items less food and energy are up 4.0% year over year as of November 2023; transportation costs are up over 10%; medical care and shelter are both up 5% or more; and the ridiculous “core” CPI, which ignores “highly volatile” food and energy costs – thankfully, these are not necessary to live – is still the darling of policymakers everywhere, who joyously ring it like the bells on the Titanic while the rest of the country wonders what illicit substances are being enjoyed by our government officials. Meanwhile unemployment is praised as the lowest in decades while ignoring the realities that not only is U3 an unreliable (we would say nearly useless) indicator of unemployment, but few of the talking heads seem overly concerned that hundreds of thousands of Americans hold multiple jobs, or that the number of multiple-job workers is likely impossible to not underestimate.

While the “everything rally” continues to amuse and bemuse the pundits (tech darling NVIDIA closed out the year trading at a P/E over 65, while the S&P 500 index traded above its historic averages, at about 20 times earnings; meanwhile the crypto HODLers celebrated the doubling in price of everyone’s favorite non-currency, non-functional, and utterly pointless science experiment – Bitcoin. Let’s examine how the Garrison portfolio fared against the broader market.

GF Fund I Performance

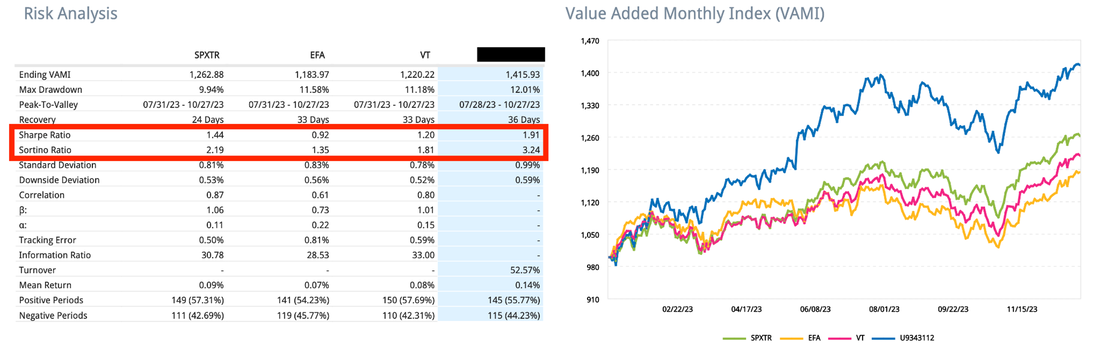

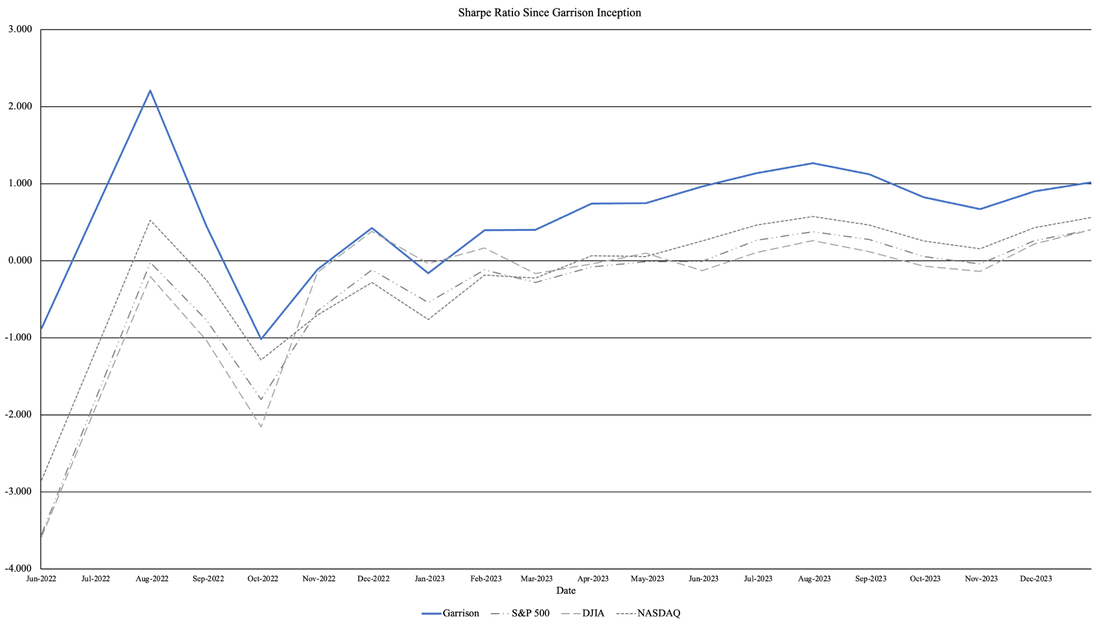

GF-I closed out 2023 up more than 42% net, trouncing both the S&P and the stalwart Dow. While we slightly underperformed the NASDAQ – a wholly unsurprising result given the triple-digit returns of stocks like Meta – we were far less volatile than the broader market: not only is the annualized Sharpe ratio (and actual Sharpe ratio) significantly higher than the indices, but the Sortino ratio of GF-I (3.24) is extremely encouraging (a Sortino greater than two is considered ideal) and supports our buy-and-hold strategy. While Sharpe maximization and infrequent rebalancing may seem quaint to modern money managers, we must reiterate a quote from the criminally underappreciated cinematic masterpiece Tron: Legacy – “it’s amazing how productive doing nothing can be."

By Willie J. Costa & Vinh Q. Vuong

The S&P 500 closed 2023 at +24.23%, the highest since the pre-tech bubble euphoria of 1999. Garrison Fathom’s Garrison Fund I (GF-I), meanwhile, finished the year +42.50% net, or about 1.75 times the return of the S&P.

Chalk one up for the merits of long-term value investing.

What did markets get right? According to The Wall Street Journal, not a whole lot. Ordinary logic would have called 2023 a bear’s dream: the Federal Reserve hiked rates at the fastest rate since Volcker saved the country from entrenched and willful ignorance in the 1980s, Silicon Valley Bank proved that no management strategy was so terrible that it couldn’t be topped by an even worse one, and war broke out in the Middle East yet again.

But stocks continued to climb. Does that mean that doom has been averted? Hardly: as we’ve mentioned in our podcast, you need to look behind the numbers to see what’s actually going on – no small task given that a stock market “melt-up” is the scenario no one wants to imagine. For instance, despite the Biden administration’s (wholly premature) celebration over “defeating” inflation, all CPI items less food and energy are up 4.0% year over year as of November 2023; transportation costs are up over 10%; medical care and shelter are both up 5% or more; and the ridiculous “core” CPI, which ignores “highly volatile” food and energy costs – thankfully, these are not necessary to live – is still the darling of policymakers everywhere, who joyously ring it like the bells on the Titanic while the rest of the country wonders what illicit substances are being enjoyed by our government officials. Meanwhile unemployment is praised as the lowest in decades while ignoring the realities that not only is U3 an unreliable (we would say nearly useless) indicator of unemployment, but few of the talking heads seem overly concerned that hundreds of thousands of Americans hold multiple jobs, or that the number of multiple-job workers is likely impossible to not underestimate.

While the “everything rally” continues to amuse and bemuse the pundits (tech darling NVIDIA closed out the year trading at a P/E over 65, while the S&P 500 index traded above its historic averages, at about 20 times earnings; meanwhile the crypto HODLers celebrated the doubling in price of everyone’s favorite non-currency, non-functional, and utterly pointless science experiment – Bitcoin. Let’s examine how the Garrison portfolio fared against the broader market.

GF Fund I Performance

GF-I closed out 2023 up more than 42% net, trouncing both the S&P and the stalwart Dow. While we slightly underperformed the NASDAQ – a wholly unsurprising result given the triple-digit returns of stocks like Meta – we were far less volatile than the broader market: not only is the annualized Sharpe ratio (and actual Sharpe ratio) significantly higher than the indices, but the Sortino ratio of GF-I (3.24) is extremely encouraging (a Sortino greater than two is considered ideal) and supports our buy-and-hold strategy. While Sharpe maximization and infrequent rebalancing may seem quaint to modern money managers, we must reiterate a quote from the criminally underappreciated cinematic masterpiece Tron: Legacy – “it’s amazing how productive doing nothing can be."

The cumulative attribution effect of the Garrison portfolio continues to trend positive, and unsurprisingly the cumulative attribution effect is what allows GF-I to continue to outperform the S&P. Part of this positive effect undoubtedly resulted from the selling of our position in Pfizer prior to the stock completing its year-long, 44% drop in value. We were hopeful for Pfizer’s performance given its leadership in the development of a coronavirus vaccine, but it is unlikely that they will be in a position to remain an industry darling for the foreseeable future. We also dropped Pfizer due to a reexamination of the industries in which we will invest versus our personal spheres of competence, and biotech and healthcare were deemed to not be sufficiently in our wheelhouse to merit further exposure.

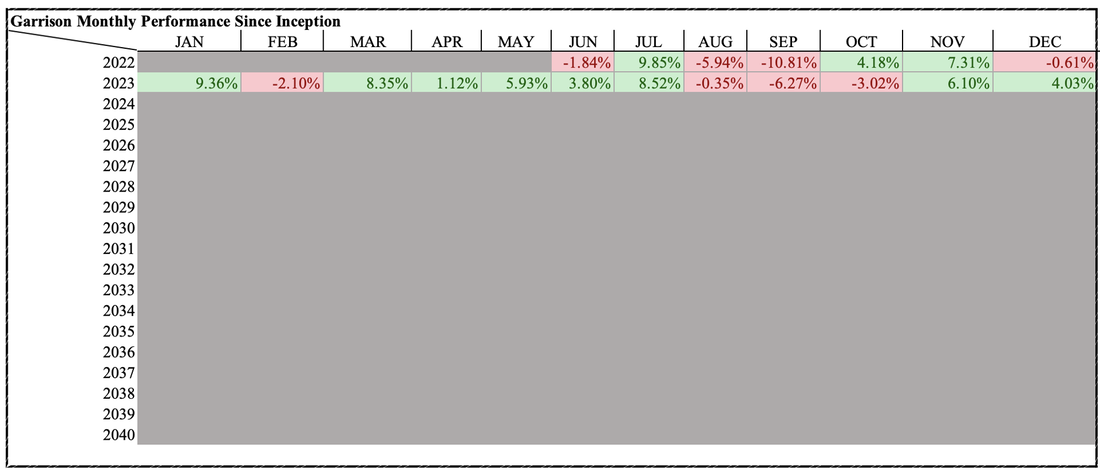

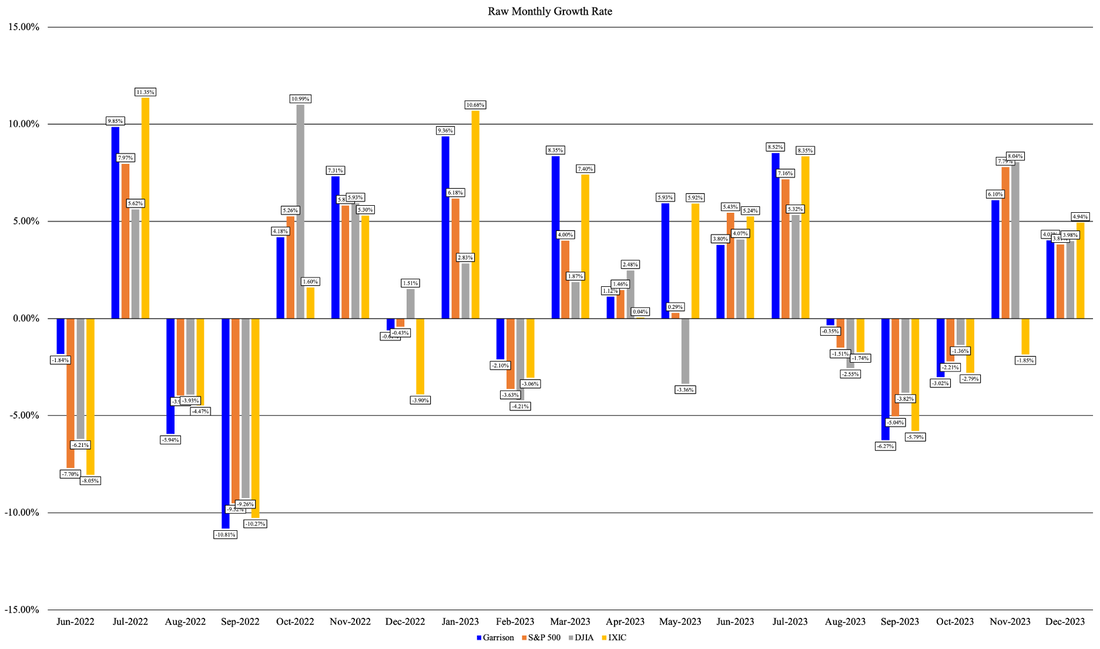

Monthly returns for 2023 are shown below. August and September continue to be down months for GF-I, and we will continue to examine the effects of seasonality and other forces on the performance of the portfolio.

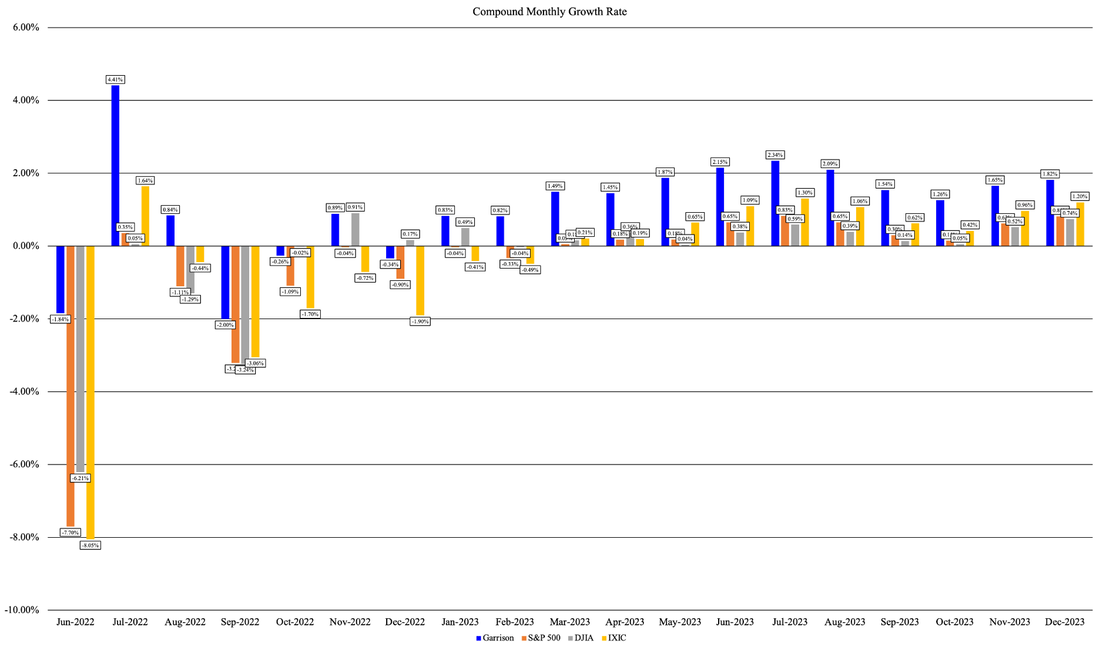

The following four graphs illustrate the benefits of a carefully-selected buy-and-hold portfolio versus the market indices. Warren Buffett’s advice to buy and hold an S&P index fund remains valid in our opinion, but the advantages of a higher Sharpe ratio (maximizing return per unit risk) begin to become obvious over time. High absolute returns are undesirable if they require high volatility to obtain, which they almost always do; instead, maintaining a consistent compound growth rate (in our case, measured as compound monthly growth rate) is the only reliable way to transform time from a threat to a weapon of wealth creation.

Changes to portfolio allocations

In addition to dropping Pfizer and Ford, we have rebalanced the Garrison portfolio to increase exposure to certain bedrock companies such as Kroger, Walmart, Costco, Coca-Cola, and Hershey; we have also rebalanced our position in JP Morgan Chase, and added Capital One and Visa to our holdings. We do not foresee a smooth 2024, especially in the financial industry, and feel $JPM and $COF are better positioned to weather unforeseen storms than competitors such as Bank of America and Wells Fargo. There’s also the issue of duration-mismatched bank assets to consider: the same issue that contributed to the downfall of Silicon Valley Bank (although it was far from the only one) will remain of concern until the Fed begins to ease interest rates.

We do not think the time is right to ease up on the fight against inflation, since as mentioned previously several of the sectors that are critical for modern life are still experiencing inflationary pressure; however, it is unlikely that Chair Powell will renege on his prophecy of rate cuts in 2024, and we will be positioned to insulate ourselves as best as possible from the downfall that inevitably follows any bout of irrational exuberance. We feel now is the time for safety, and have pared down our position in highly volatile tech stocks like $NVDA and $TSM as a result. Visa ($V) was added to our portfolio as a bedrock position given that payment services are unlikely to ever be obviated.

We have also added Northrop Grumman ($NOC) based on expected appreciation of the stock as well as strong dividend cash flows; the first flight of the B-21 unmanned bomber also presents the opportunity for steady future cash flows in terms of production, training, and MRO revenues. We also remain bullish on oil supermajors like Chevron ($CVX) and Oxy ($OXY), both for their strong dividend cash flows (Chevron’s dividend yield at the time of writing is over 4%) and the continued reliance upon their products by the world at large. These three stocks are also well-positioned to enjoy revenue benefits caused by the uncertainties of geopolitical conflict and an uncertain OPEC production quota.

We remain bullish on Japanese super-zaibatsu Itochu ($8001), as it is the epitome of our philosophy of steady performance without undue risk. Its major divisions (textiles, machinery, metals and minerals, energy and chemicals, food, general products, realty, logistics, forestry, and financial services) form the cornerstones of society, and will likely continue to ensure strong cash flows and low price volatility. We may increase our position in Itochu at some point in 2024.

Rocket Lab ($RKLB) remains our high-potential darling. The company launched ten rockets in 2023, and remains the go-to launch provider for smaller satellite companies (including NorthStar, which recently raised $15 million for orbital debris tracking). Earnings are still negative due to the company’s expansion efforts in continuing development of the Neutron rocket (a mega-constellation launcher capable of lofting 13,000 kg to low orbit, or 1,300 to a Mars or Venus trajectory, as well as potentially being Rocket Lab’s first human-rated launch vehicle), but a recent $515 million-dollar US government contract demonstrates that management are unwilling to sacrifice sound business practices to chase scientific breakthroughs.

The current GF-I portfolio structure is given below. Approximately 2% of our assets under management is currently held in reserve.

In addition to dropping Pfizer and Ford, we have rebalanced the Garrison portfolio to increase exposure to certain bedrock companies such as Kroger, Walmart, Costco, Coca-Cola, and Hershey; we have also rebalanced our position in JP Morgan Chase, and added Capital One and Visa to our holdings. We do not foresee a smooth 2024, especially in the financial industry, and feel $JPM and $COF are better positioned to weather unforeseen storms than competitors such as Bank of America and Wells Fargo. There’s also the issue of duration-mismatched bank assets to consider: the same issue that contributed to the downfall of Silicon Valley Bank (although it was far from the only one) will remain of concern until the Fed begins to ease interest rates.

We do not think the time is right to ease up on the fight against inflation, since as mentioned previously several of the sectors that are critical for modern life are still experiencing inflationary pressure; however, it is unlikely that Chair Powell will renege on his prophecy of rate cuts in 2024, and we will be positioned to insulate ourselves as best as possible from the downfall that inevitably follows any bout of irrational exuberance. We feel now is the time for safety, and have pared down our position in highly volatile tech stocks like $NVDA and $TSM as a result. Visa ($V) was added to our portfolio as a bedrock position given that payment services are unlikely to ever be obviated.

We have also added Northrop Grumman ($NOC) based on expected appreciation of the stock as well as strong dividend cash flows; the first flight of the B-21 unmanned bomber also presents the opportunity for steady future cash flows in terms of production, training, and MRO revenues. We also remain bullish on oil supermajors like Chevron ($CVX) and Oxy ($OXY), both for their strong dividend cash flows (Chevron’s dividend yield at the time of writing is over 4%) and the continued reliance upon their products by the world at large. These three stocks are also well-positioned to enjoy revenue benefits caused by the uncertainties of geopolitical conflict and an uncertain OPEC production quota.

We remain bullish on Japanese super-zaibatsu Itochu ($8001), as it is the epitome of our philosophy of steady performance without undue risk. Its major divisions (textiles, machinery, metals and minerals, energy and chemicals, food, general products, realty, logistics, forestry, and financial services) form the cornerstones of society, and will likely continue to ensure strong cash flows and low price volatility. We may increase our position in Itochu at some point in 2024.

Rocket Lab ($RKLB) remains our high-potential darling. The company launched ten rockets in 2023, and remains the go-to launch provider for smaller satellite companies (including NorthStar, which recently raised $15 million for orbital debris tracking). Earnings are still negative due to the company’s expansion efforts in continuing development of the Neutron rocket (a mega-constellation launcher capable of lofting 13,000 kg to low orbit, or 1,300 to a Mars or Venus trajectory, as well as potentially being Rocket Lab’s first human-rated launch vehicle), but a recent $515 million-dollar US government contract demonstrates that management are unwilling to sacrifice sound business practices to chase scientific breakthroughs.

The current GF-I portfolio structure is given below. Approximately 2% of our assets under management is currently held in reserve.

Closing thoughts and future outlook

The past couple of years have been volatile to say the least, and we do not see this as the time to onload any unnecessary risk for our investments. Predictions of market returns for 2024 are split at best, and while we believe in being greedy when others are fearful – and of buying when there’s blood in the streets, even if the blood is our own – the split sentiments among experts and uncertain macroeconomic outlook only further validates caution. We feel that interest rate hikes are not over regardless of media platitudes by the Fed, and that enough securities are overpriced to potentially cause cascades of sell-offs once necessary price corrections occur. The majority of Americans have burned through their pandemic savings and will likely be worse off in 2024 than they were in 2019. Stories of robust consumer spending leading into the 2023 holiday season must be balanced with the reality of record-high revolving consumer debt and sky-high credit card interest rates: Americans may have very likely been revenge-spending with credit and will soon face a reckoning. Rumors of the death of runaway inflation are likely greatly exaggerated given that inflationary pressures on often-ignored (but necessary) expenses are still high. The free lunch is over, and the bill comes due.

As always, complete trade history for the year and broker-generated report of holdings are available upon request.

The past couple of years have been volatile to say the least, and we do not see this as the time to onload any unnecessary risk for our investments. Predictions of market returns for 2024 are split at best, and while we believe in being greedy when others are fearful – and of buying when there’s blood in the streets, even if the blood is our own – the split sentiments among experts and uncertain macroeconomic outlook only further validates caution. We feel that interest rate hikes are not over regardless of media platitudes by the Fed, and that enough securities are overpriced to potentially cause cascades of sell-offs once necessary price corrections occur. The majority of Americans have burned through their pandemic savings and will likely be worse off in 2024 than they were in 2019. Stories of robust consumer spending leading into the 2023 holiday season must be balanced with the reality of record-high revolving consumer debt and sky-high credit card interest rates: Americans may have very likely been revenge-spending with credit and will soon face a reckoning. Rumors of the death of runaway inflation are likely greatly exaggerated given that inflationary pressures on often-ignored (but necessary) expenses are still high. The free lunch is over, and the bill comes due.

As always, complete trade history for the year and broker-generated report of holdings are available upon request.

Subscribe to updates or if you have any questions or comments, please email us at: [email protected]

Follow our CEO: @thevinhvuong

Follow our COO: @thewilliecosta

Follow Garrison Fathom: @garrisonfathom

Follow our CEO: @thevinhvuong

Follow our COO: @thewilliecosta

Follow Garrison Fathom: @garrisonfathom