|

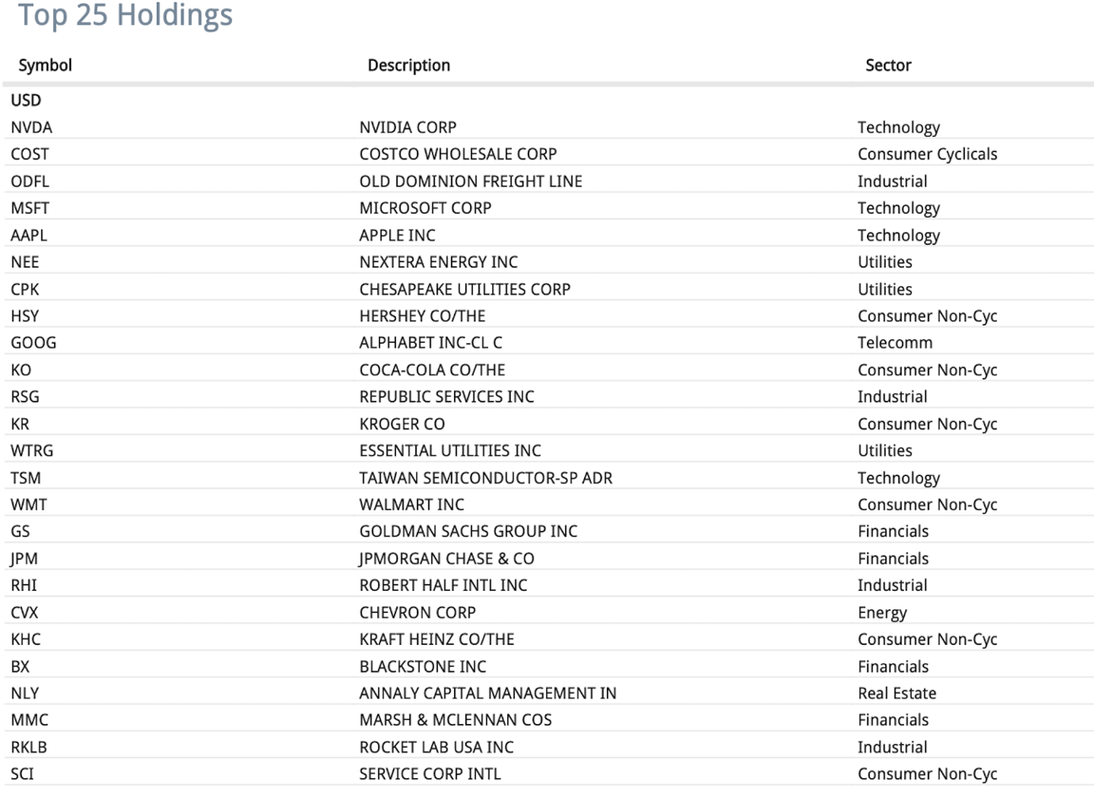

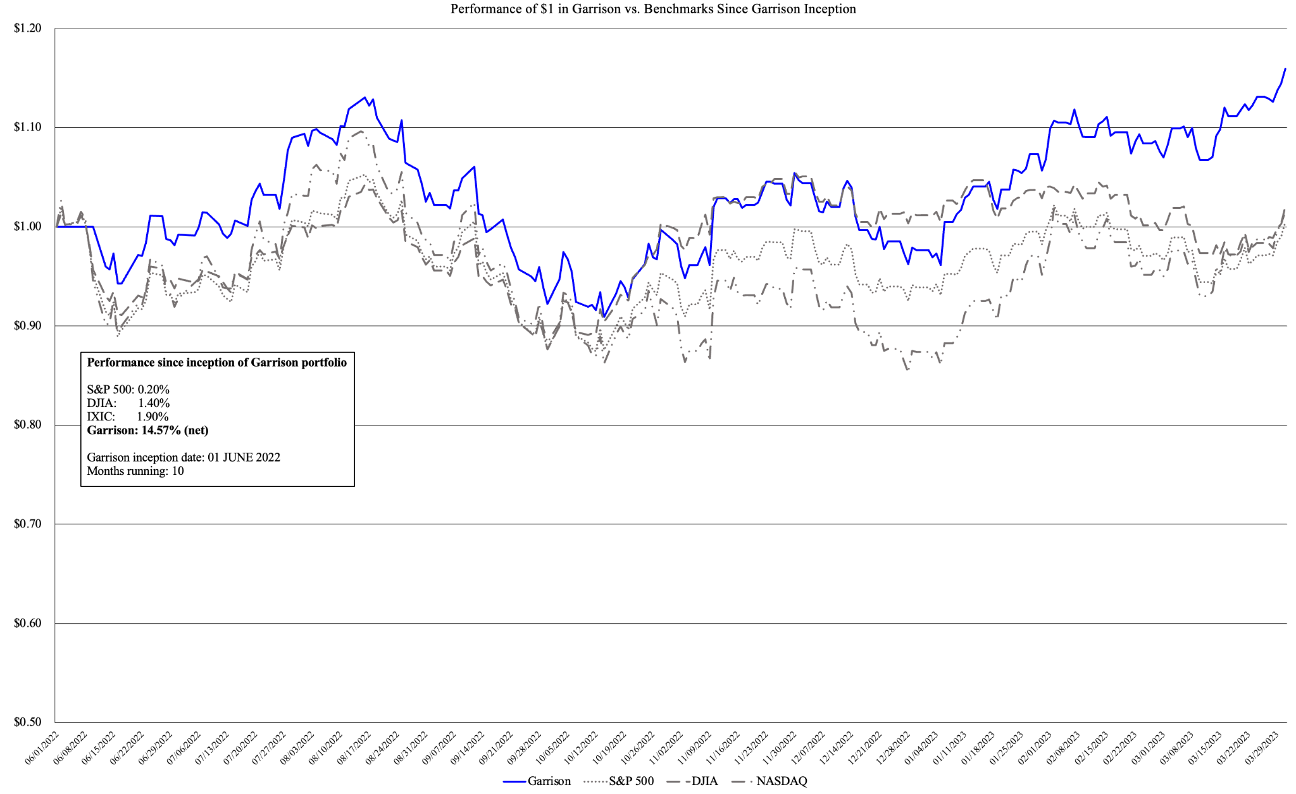

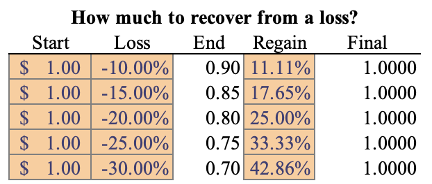

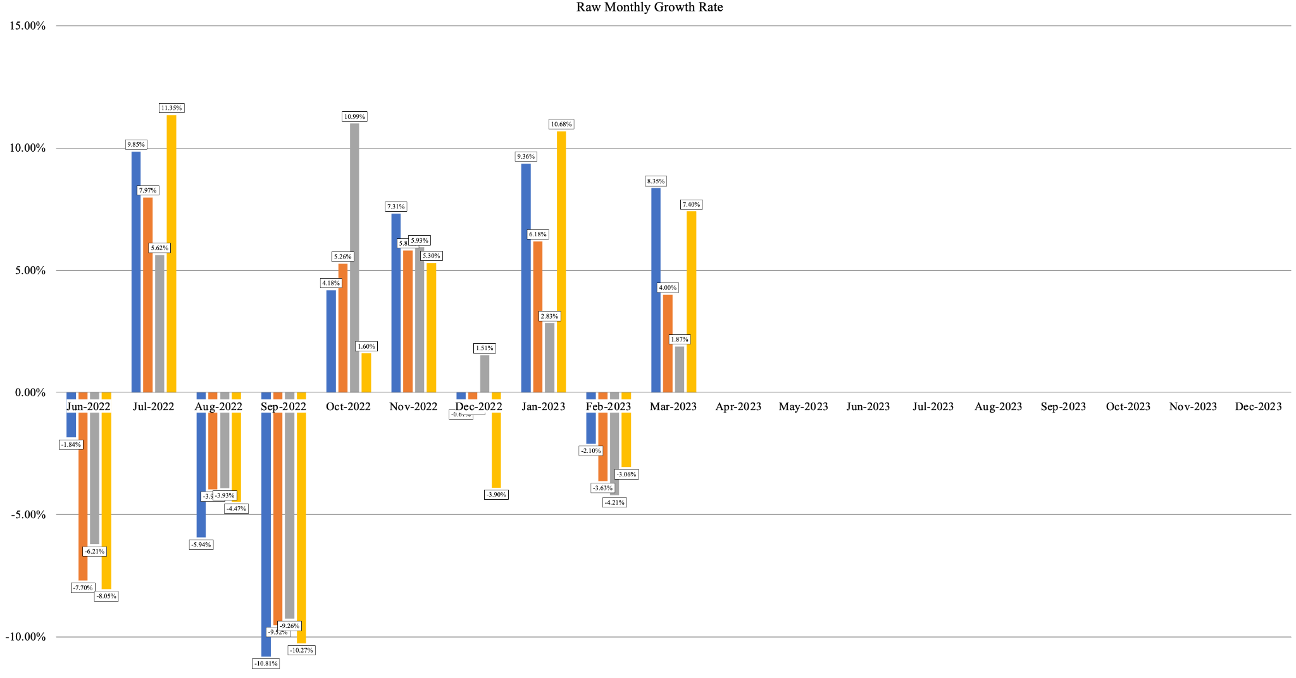

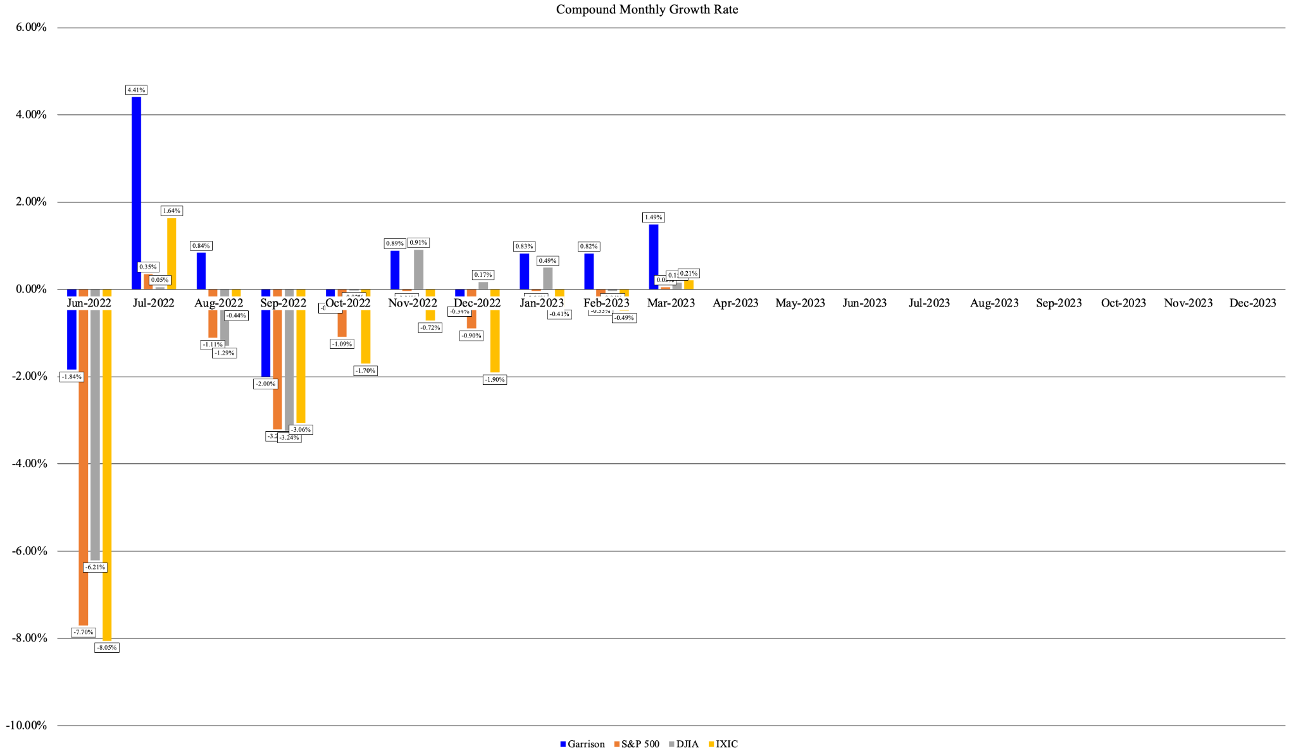

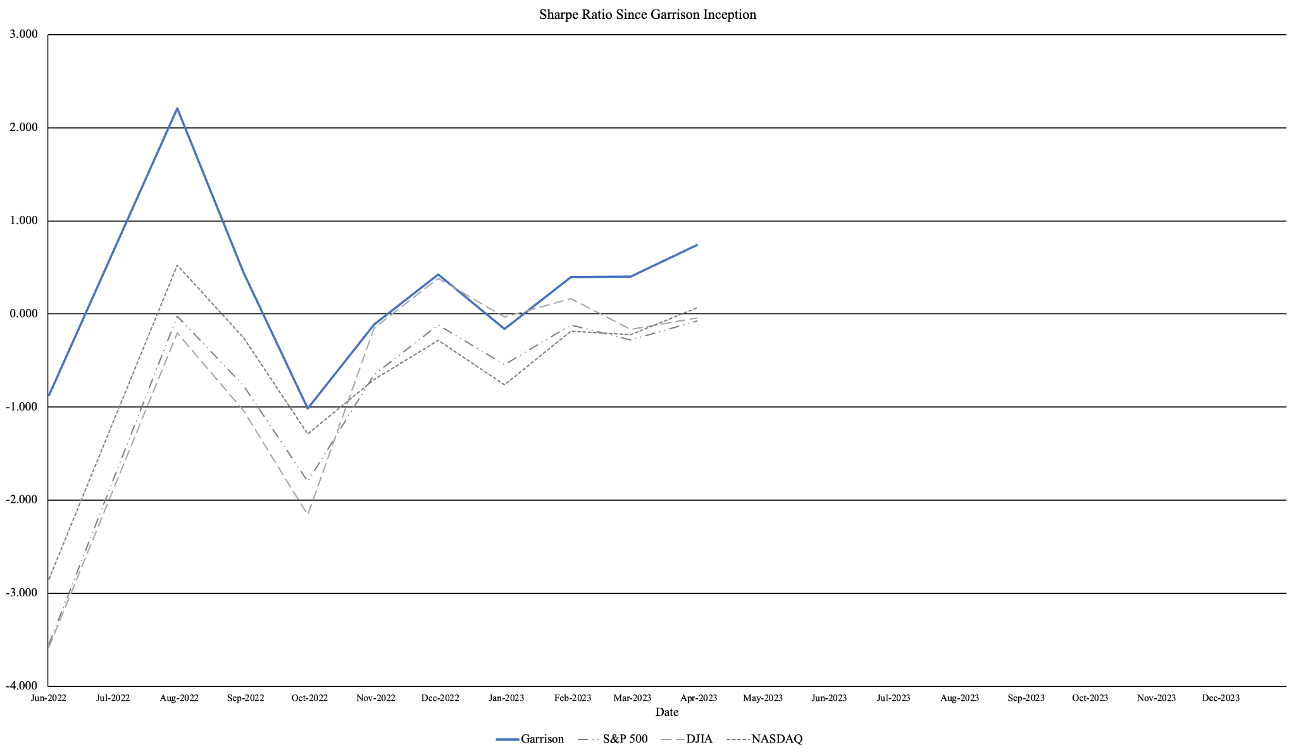

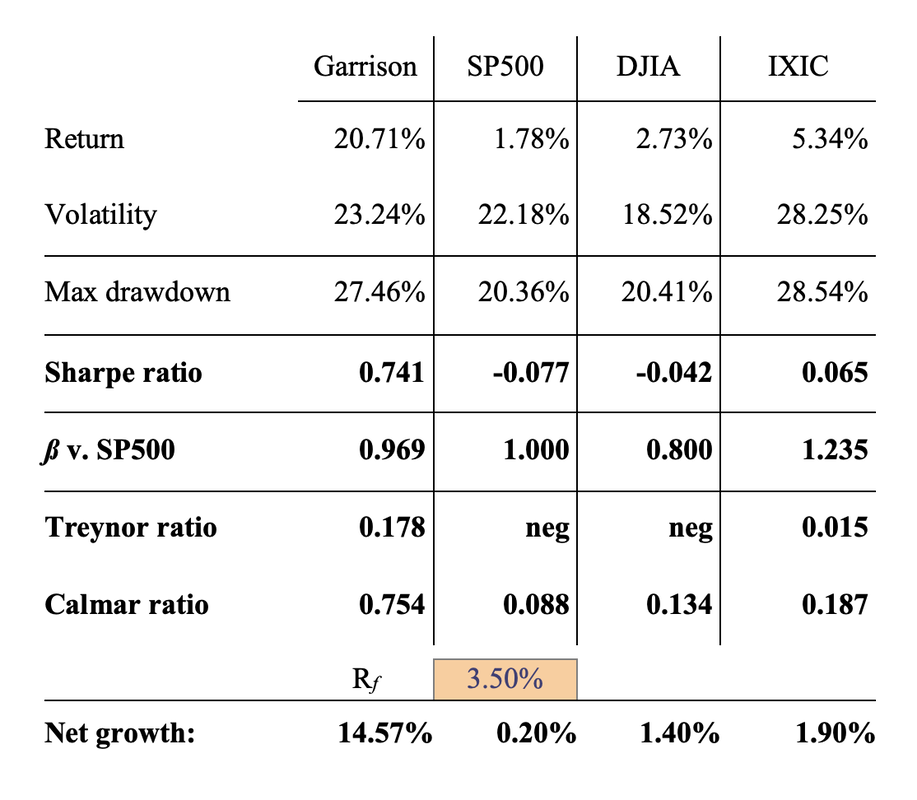

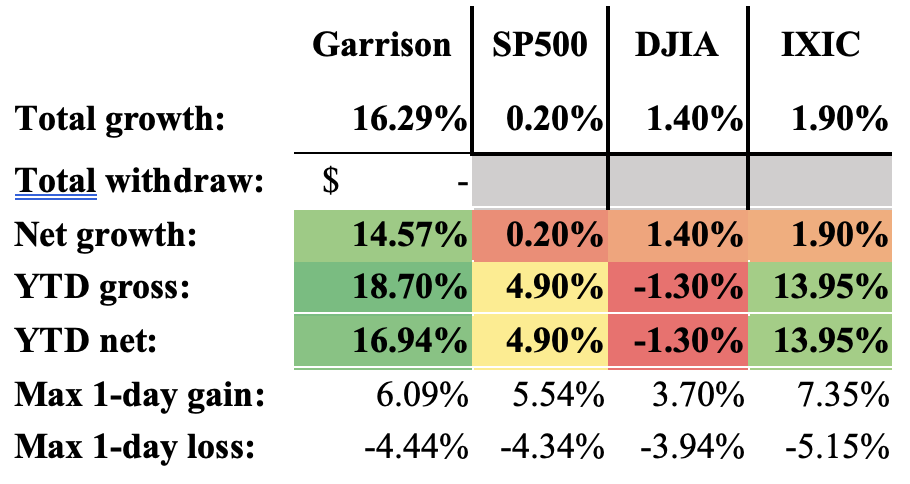

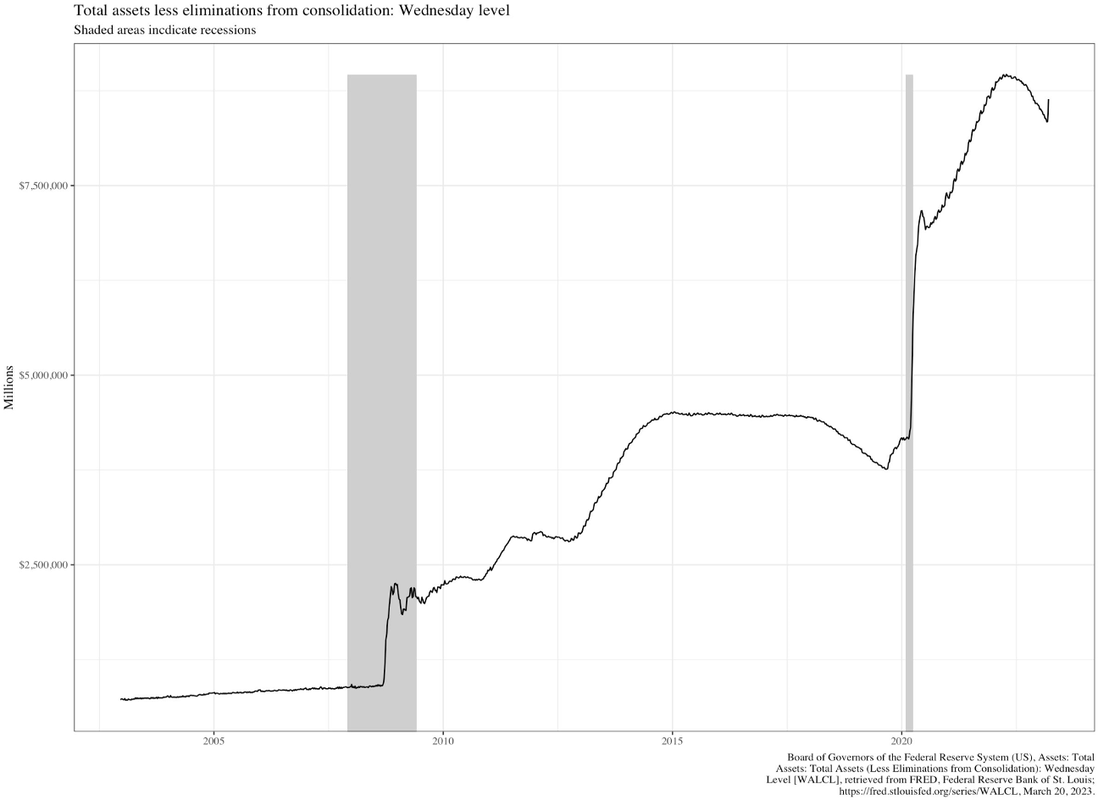

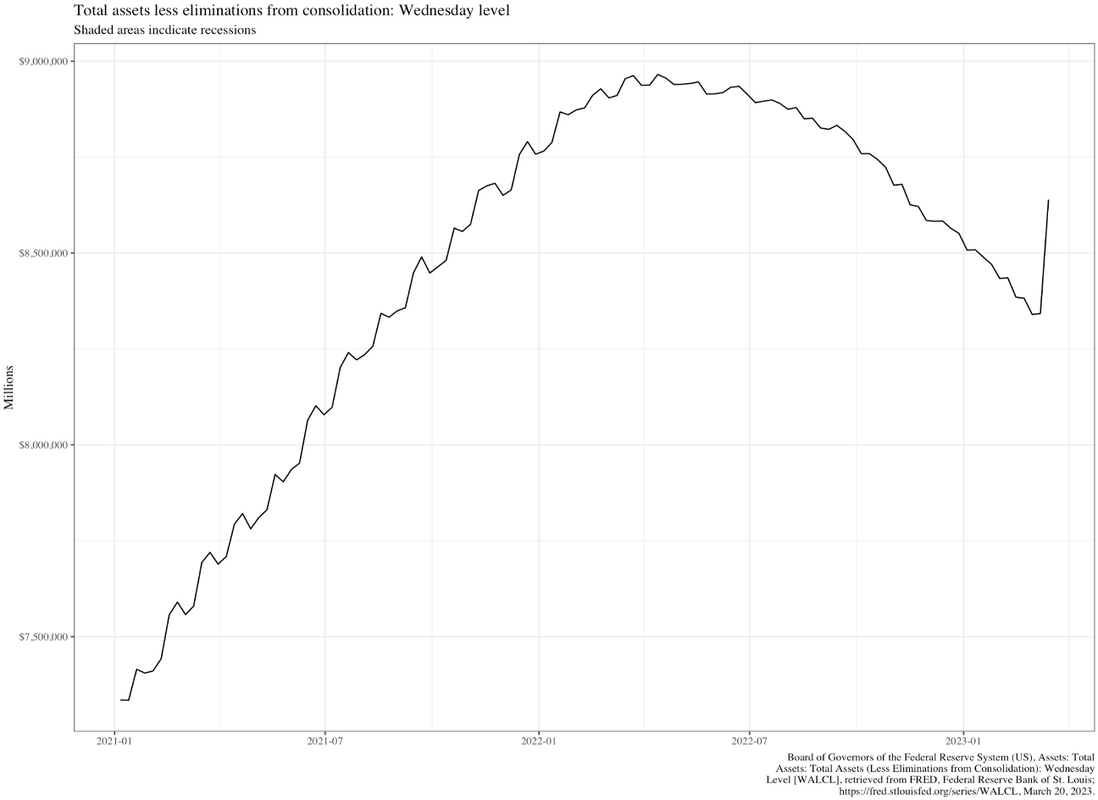

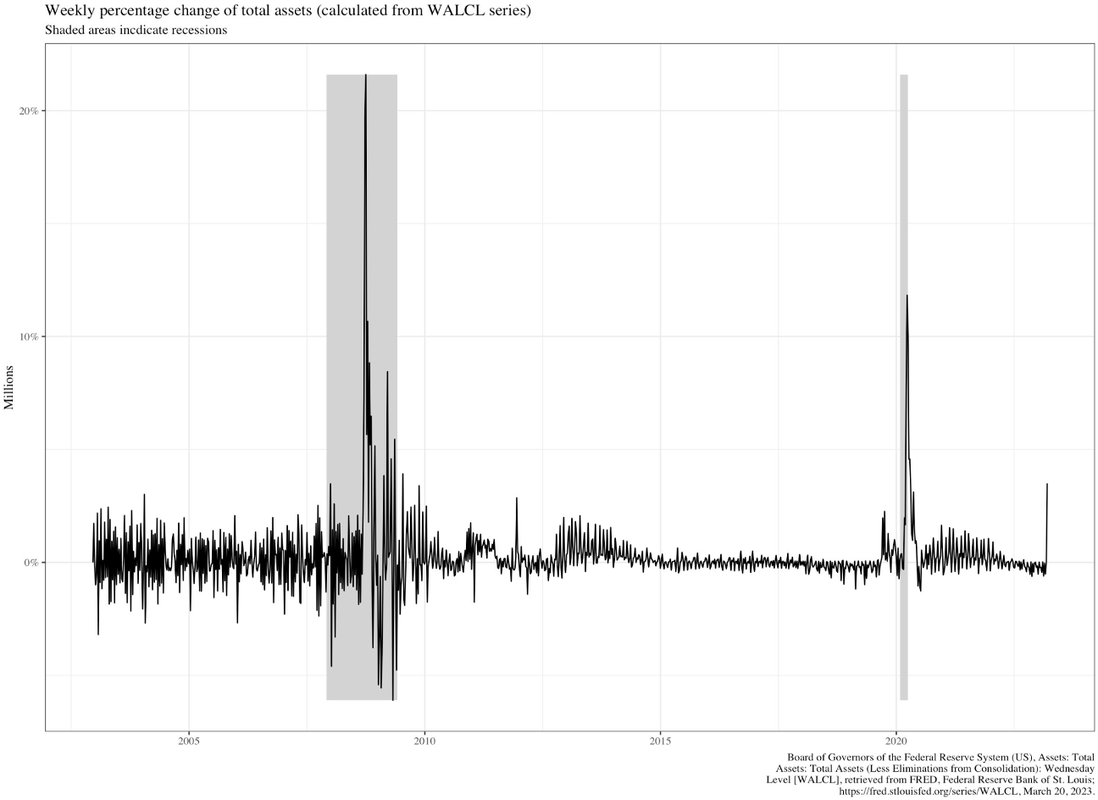

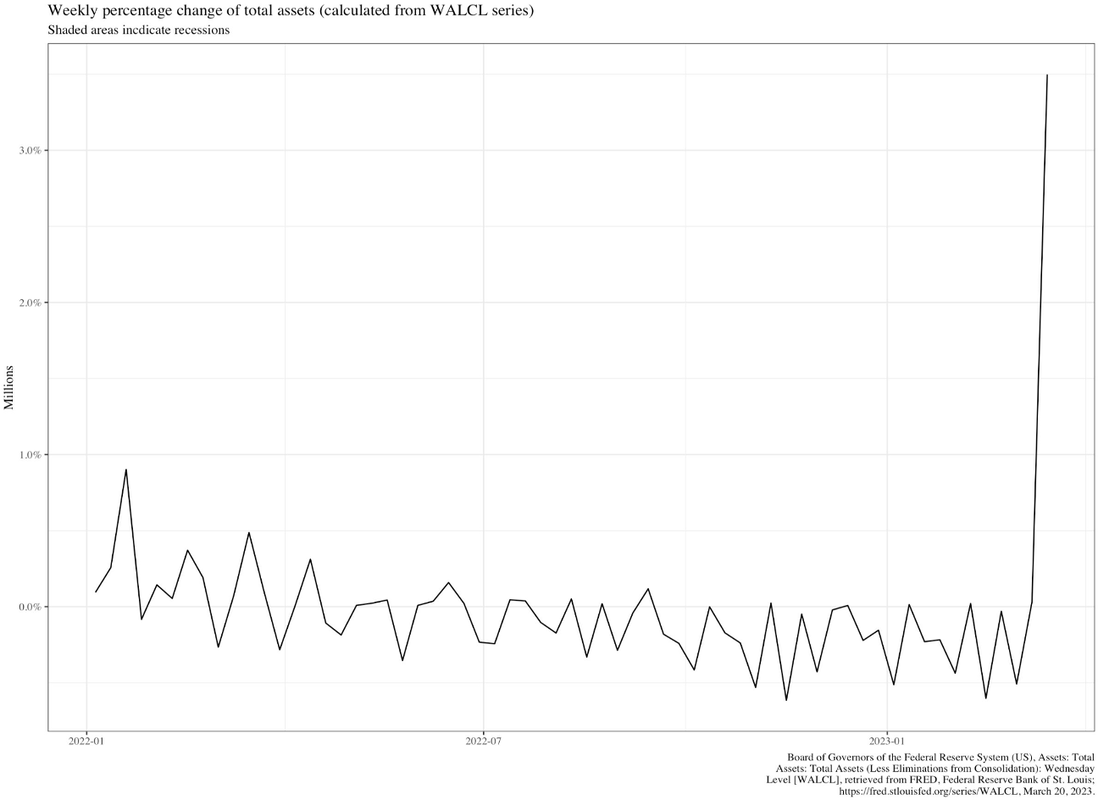

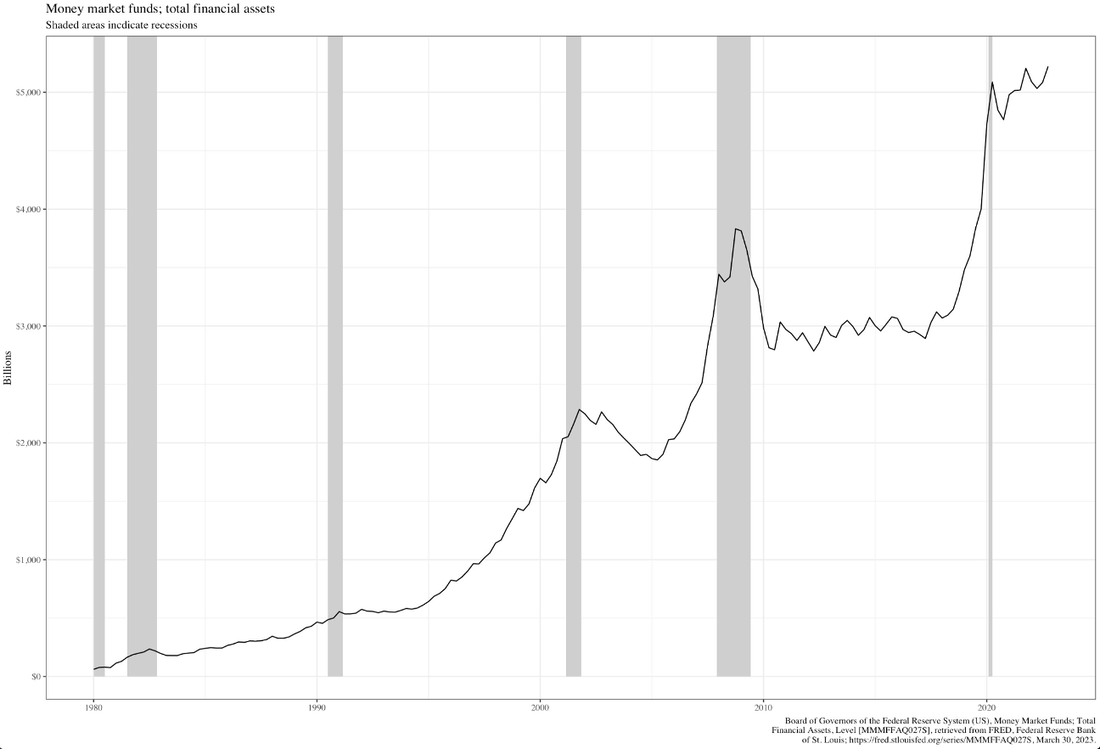

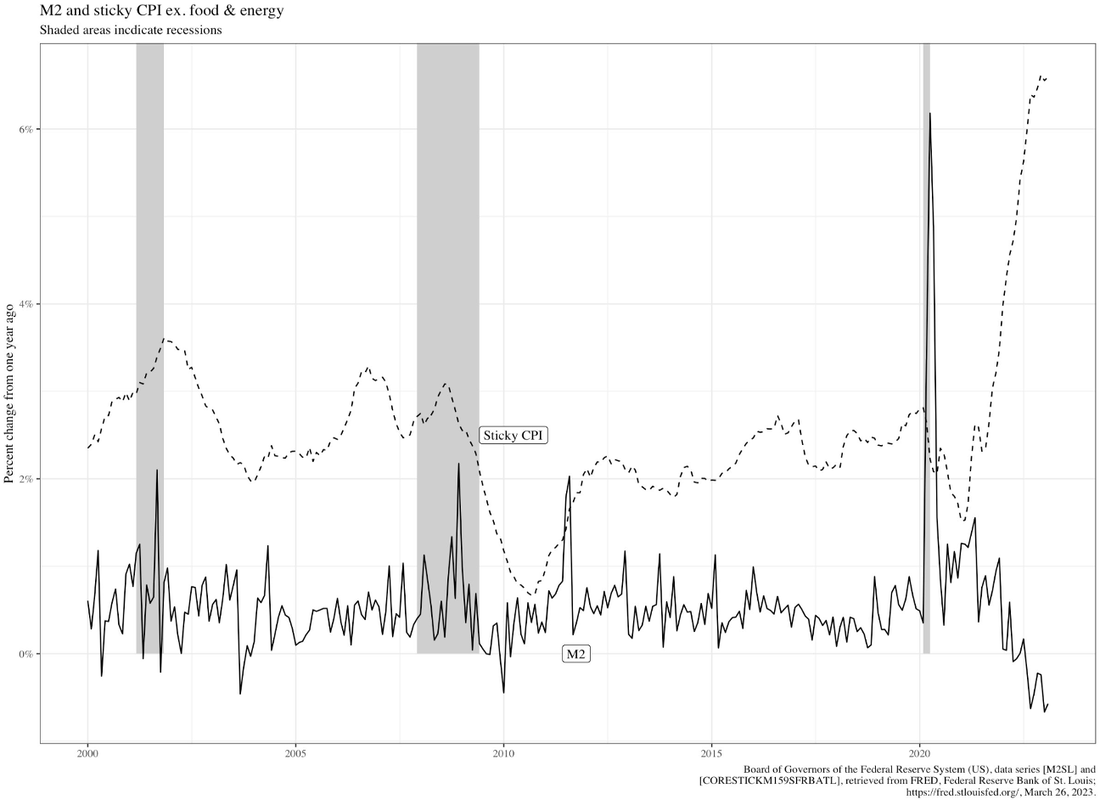

Garrison portfolio up 18.70% YTD, 16.94% YTD net, and 14.57% net since inception The first quarter of 2023 was far from placid: there were multiple bank failures, the BRICS countries dared to take the first step toward de-dollarization, the war of Russian aggression rages on, and the Fed will likely need to continue rate hikes to battle inflation (or run the risk of the economy turning toward stagflation). To make matters worse, global corporate defaults are happening at the fastest pace since 2008, and there are signs that economies in the eurozone are signaling a recession despite the masses maintaining that one or more markets (depending on your particular delusion of choice) will be fine. There is no such thing as “fine” anymore: the world economies are far too interconnected to truly insulate oneself at home from turbulence abroad. But there is still light at the end of the tunnel: proper investment strategy, combined with a long-term vision, remains the most dependable strategy regardless of external factors. The summary of quarterly and YTD is given below. Portfolio allocationThe Garrison portfolio positions are allocated as follows: We have not made any significant changes to our positions during this quarter. Performance since inceptionOn a sufficiently long timeline, the result of superior strategies will begin to emerge. As previously mentioned, the point of the Garrison strategy is to balance volatility with reward by minimizing the former whenever possible. Our portfolio remains firmly invested in staples with strong economic moats and highly-defensible market positions, and our Sharpe-Kelly optimization is beginning to demonstrate performance that is notably superior to the indices. The losses incurred in late 2022 were unfortunate, but as can be seen were losses that were experienced by the broader market. Certain economic forces are unavoidable regardless of positioning; that is the downside of a strategy that relies solely on long-term appreciation rather than short-term cover. The Garrison portfolio shows the benefits of maintaining consistent performance over multiple periods, rather than trying to achieve large gains to cover large losses. In fact, any loss will always require a higher gain just to get back to where one started, as shown below: It becomes readily apparent that the situation becomes supremely dire as the magnitude of the loss increases: a 30% loss within one period (say, one year) would require a gain of almost 43% within the same period to offset. For instance, if a portfolio lost 30% within a year, it would need to gain 43% within that same year – something that the S&P 500 has done only twice since 1930 – to get back to its original value. It is therefore more prudent to minimize losses (or, rather, to maximize potential gain for each unit of volatility) than to optimize gains. Viewed on a monthly scale, the Garrison portfolio has not shown repeated outsized performance relative to the conventional indices: However, when viewed on a compounding scale, the advantage of the Sharpe-maximization approach becomes readily apparent: Similarly, the Sharpe ratio of the Garrison portfolio has grown steadily since the late-2022 downturn: Estimated annual performance since inceptionAfter three quarters, there is sufficient data to begin estimating the expected annual performance of the Garrison portfolio; this, along with the current metrics of interest (Sharpe, Treynor, and Calmar ratios, as well as beta versus the S&P 500) are as follows: Year-to-date performanceThe Garrison portfolio dominated the indices for Q1 of 2023, as shown below: The correlation of securities within the Garrison portfolio is structured to asymmetrically influence the performance of the portfolio: note that the maximum single-day gain of Garrison nearly exceeds that of the famously volatile NASDAQ Composite, with downside comparable to the more conservative S&P and Dow. This is, of course, by design, and Garrison is expected to continue exhibiting similar behavior in the future. Closing thoughts and future outlookHistorically, April has been a good month for stock performance: companies have released their Q4 earnings from the previous year from January through March, and a “spring cleaning” of sorts occurs as weaker companies are identified (or accused) and investors shift capital to stronger prospects for the year. This is not necessarily our approach. While we are always evaluating our positions to most efficiently deploy capital, none of our positions have been entered with a near-term horizon. We are more than willing to absorb short-term drawdowns for long-term performance. That said, there are times when macro forces create obviously (dis)advantageous opportunities for entry without necessarily trying to “time” the market. For instance, we expect rate hikes to continue this year due to the persistence of inflation, although the slower inflation is brought down the higher the risk of a sharp downturn. We’ve mentioned before that the Fed’s response to inflation has been tepid at best, but unfortunately inflation has continued to grow for so long – and to begin adversely influencing economies around the world – that now is probably not the best time to rip the Band-Aid off. That time was in mid-2021; now, we must be satisfied with incremental hikes and hope for the best. There are other recessionary signals to consider. First and foremost, the Fed’s balance sheet remains high, no doubt due to the grand experiment of quantitative easing from which we’re still trying to recover. As the following images demonstrate, the Fed’s balance sheet is normally sideways or changing gradually; sharp increases, such as those during the Great Recession and 2020, tend to have knock-on effects that are usually less desirable than the irrational market exuberance they cause. There have also been rather concerning upticks in the total assets of money market funds. While these are typically a safe way to protect assets during a downturn, they are not ideal for long-term growth; however, they do provide some often much-needed liquidity during a recession. Historically, sharp increases in money market fund inflows have presaged a recession; if one were to believe in the hypothesis of a (semi-)efficient market and that asymmetric information is eventually priced in, the fact that the post-2020 downturn in money market inflows was so short-lived should be concerning. This leads back to the question of inflation and debt, as almost all macro observations must. Currently, the total amount of revolving consumer credit is the highest in sixty years – over $1.2 trillion. Debt is not in and of itself undesirable – the key is what an investor (or consumer) can obtain for every dollar of debt incurred – but when debt is combined with broader adverse conditions, the perfect conditions for a catastrophe are formed. The real terror is seen when examining the year-on-year change in M2 and sticky CPI: The post-2021 divergence between the two is only part of the danger: the year-on-year change in M2 has not once been this negative since 1960. The sharp decrease in M2, combined with the sharp increase in revolving consumer debt, highlights what several news outlets have mentioned: Americans are increasingly relying on credit card debt to fund normal activity, which will create an incredibly undesirable feedback loop as the Fed continues to raise rates and credit card companies follow suit. The divergence of the above chart suggests that the sharp decrease in M2 is due to a decrease in savings, which is logical given the still-hot inflationary environment.

Americans are teed up for a perfect storm of economic misery: high debt load, potentially still-high interest rates, and a contracting economy. We foresee that if a recession is to occur – the data suggest that this is highly likely – it will likely begin late Q3 or mid-Q4 of this year. With that in mind, we are evaluating several industrial companies that will enhance the value of our portfolio, but we will not be taking positions within them until it becomes clear that we are either deep into a recession or obviously clear of it. We are also evaluating several agricultural companies (specifically grains, oilseeds, food processing, agricultural storage, fertilizer production, and transportation) that show good promise for sustained performance even during a downturn: no matter how bad the economy, people still need to eat. Similarly, we are examining potential opportunities within utilities and logistics. The coming quarter is a momentous occasion, as it will mark the conclusion of the first entire year of performance for the Garrison portfolio. We look forward to a potentially volatile quarter that will continue to demonstrate the merits of our philosophy of sound investing in fairly-priced companies with excellent long-term prospects.

1 Comment

|

CategoriesArchives |

RSS Feed

RSS Feed